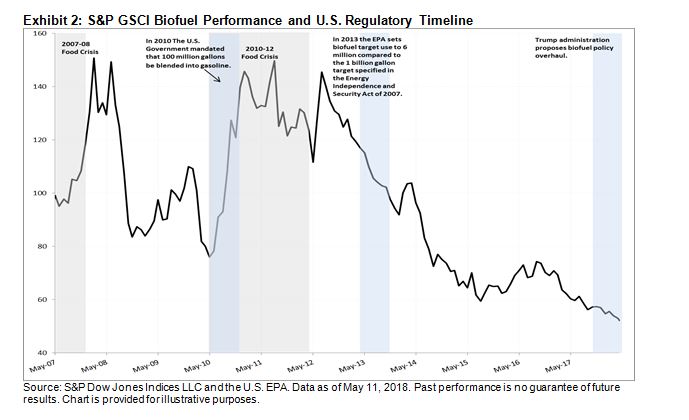

Having broken through 2% in January 2018, the 10-year U.S. Treasury breakeven rate (as measured by the difference between the S&P U.S. Treasury Bond Current 10-Year Index and the S&P U.S. TIPS 10 Year Index) has continued to increase, reaching a YTD high of 2.18% on April 23, 2018.

As of May 14, 2018, the breakeven level sat at 2.16%. These levels have not been seen since late August 2014. A rise in oil prices to around USD 70 per barrel has boosted inflation expectations, but not to the point of being “runaway” levels. A weak U.S. dollar has pushed oil prices up more in the U.S. than in other countries.

U.S. consumer prices rose less than expected for April 2018 (0.1% versus the prior 0.2%, Core CPI month-over-month), leading to speculation that the Fed will be gradual in its future rate increases. Two additional rate hikes have been the market’s expectation for 2018.

Though the U.S. Jobless Claims number was unchanged at 211,000, continued tightening in the labor markets, wage growth, and GDP (2.9%) growth will likely have an impact on inflation.

Housing prices continue to climb as the S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index reported an increase of 0.7% for the end of February 2018. Seattle, Las Vegas, and San Francisco continue to report the highest year-over-year gains among the 20 cities. All of the cities reported increases before and after seasonal adjustment, and the index has eclipsed its July 2006 peak by 0.1%.

For now, the inflation picture seems to be a slow rise, with the breakeven rate hovering around the current level of 2.16%.

Exhibit 1: Breakeven Inflation Rate

The posts on this blog are opinions, not advice. Please read our Disclaimers.