Buy-write strategies, also known as covered calls, are a staple offering for income-seeking market participants who sell, or “write,” call options against shares of assets they already own in order to generate income from the option premium. However, the option seller forfeits the upside potential of the asset and is obligated to sell the asset to the buyer of the option if it is exercised.

Since 2002, CBOE has launched a suite of buy-write indices that covers all major U.S. equity benchmarks. Exhibit 1 shows the buy-write indices based on the S&P 500.

The BXM is considered the benchmark index for buy-write strategies. It writes standard monthly at-the-money (ATM) call options based on the S&P 500 and holds the options to maturity before they are cash settled. All dividend and option premiums are fully reinvested in the index.

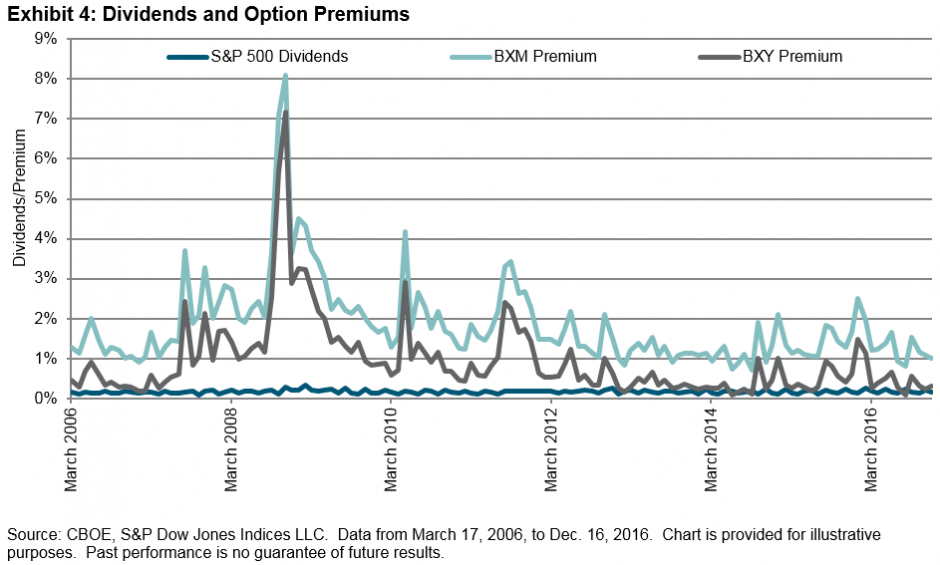

According to the roll data published by CBOE, between March 17, 2006, and Dec. 16, 2016, the short call position went in-the-money (ITM) and was exercised in 85 out of 130 months (65.38%). This implies that any gain from the S&P 500 was offset by the short call cash settlement in almost two out of three months, and that in the other months, the S&P 500 decreased or was unchanged. Based on this data, the growth in the BXM mainly came from the reinvestment of the stock dividend and the call option premium.

Taking the monthly roll data published by CBOE, we tested several distribution plans based on the BXM (see Exhibit 2). Assuming we invested USD 100 in the BXM on March 17, 2006, on Dec. 16, 2016, we would end up with USD 165.57 if all dividends and premiums were reinvested, but only USD 11.47 if all dividends and premiums were immediately distributed every month. With an annual distribution of 4.5%, we would end up with USD 102.13, almost at par with the initial portfolio value. Although the option premium seemed high at 1.84% per month, distributing 1% monthly (or 12% annually) would have reduced the portfolio value by one-half in these 130 months.

The BXY is another popular buy-write index, which writes 2% out-of-the-money (OTM) call options based on the S&P 500 every month. It allows the equity to grow up to 2% between monthly rolls but takes in a lower call premium as a tradeoff.

To illustrate the impact of the moneyness of options on distribution of cash flows, we ran a similar test on the BXY (see Exhibit 3). For the same time period, USD 100 invested in the BXY grew into USD 197.86 and USD 44.86 if all dividends and premiums were distributed immediately. The portfolio ended up almost at par (USD 103.93) if the index distributed 6% annually.

Exhibits 4 and 5 show that the option premiums collected from BXM were much higher than from BXY.

These tests illustrate the trade-off of a typical buy-write strategy: ATM option premiums are usually larger than the OTM option premiums, but selling ATM options forgoes all the upside of the stock market. The equity position has no upside but the potential cost of options being exercised. For income-seeking market participants, picking a proper buy-write portfolio to meet a specific distribution goal has to take both the equity growth and the call premium into consideration.

The posts on this blog are opinions, not advice. Please read our Disclaimers.