The sports apparel and footwear company Under Armour recently experienced a highly publicized loss of stock value, based on a couple of missteps. The first misstep was falling short of Wall Street’s earning expectations, which caused multiple brokerage firms to downgrade their stock recommendations. The second was inaccurate forecasting of the company’s revenue; it only rose by 12%, while the management team had been projecting a 22% increase. The final misstep was the resignation of the company’s CFO. Though personal reasons were stated for this, the perception of the change and its timing has turned a concerned eye on the management situation.

Though the current news was unsettling for equities, Under Armour’s debt consists of one bond (USD 600 million at 3.25%, issued on June 15, 2016), which is a component of the S&P 500® Bond Index (0.013%). Underneath the S&P 500 Bond Index are two subindices, as the debt in the index is divided into investment grade and high yield. As of Feb. 9, 2017, Under Armour holds a 0.014% weight in the S&P 500 Investment Grade Corporate Bond Index, and the apparel, accessories & luxury goods industry subsector consists of a 0.08% weight. The bond has been included among other apparel issuers, such as Coach, Ralph Lauren, and VF Corporation.

In response to the most recent events, the Under Armour bond has been downgraded to BB+ and will be moved out of the investment-grade index and into the S&P 500 High Yield Corporate Bond Index at the next month-end rebalancing (February 2017), as per the index rules. It will leave behind its investment-grade apparel group to join the high-yield apparel issues of Hanesbrands and PVH Corp., which have a weight of 0.59% as of Feb. 9, 2017, but will increase to 0.72% with the inclusion of Under Armour.

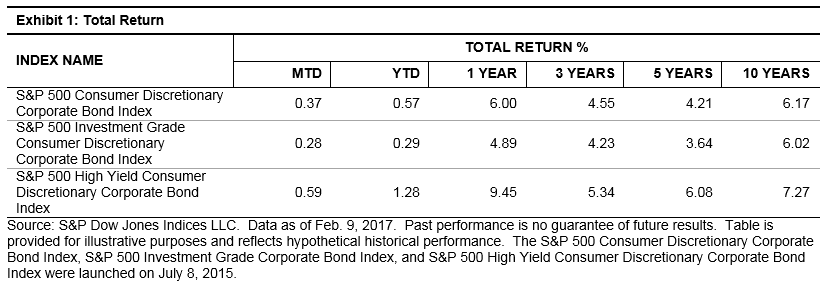

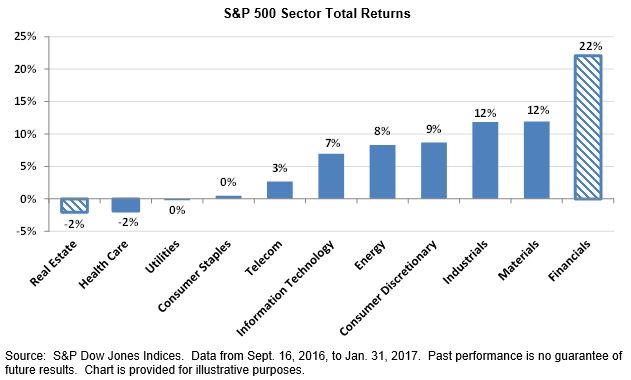

For now, this appears to be an isolated event, as the total return of the consumer discretionary sector, of which apparel, accessories & luxury goods is a component, has continued to provide consistent positive returns (see Exhibit 1).