Donald Trump’s unexpected success initially threatened to send the U.S. equity markets into steep decline. Yet as I write, the S&P 500 has moved very little since yesterday’s close (it is up a little), while the VIX has fallen dramatically.

So why (or how) has volatility remained so low this morning when everyone expected it to rise? One reason may be that stock-level volatility has risen, but correlations have dramatically fallen.

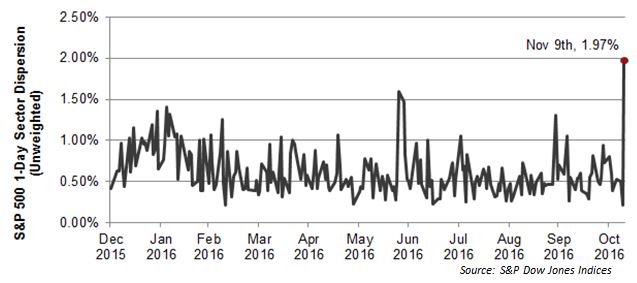

A quick calculation using sector data suggests the higher dispersion in stock-level returns. The chart shows the standard deviation among the 11 sectoral daily returns, So far today (as of 1pm EST) it is at the highest level this year. There is volatility, but the winners are cancelling out the losers.

Higher dispersion – which was already rising in advance of the election, means a greater difference between winners and losers. Today’s increase in dispersion – which may well prove temporary – is an indication of the degree to which Trump’s presidential victory, and continued Republican control of the Senate, were not appreciated by yesterday’s market consensus.

The posts on this blog are opinions, not advice. Please read our Disclaimers.