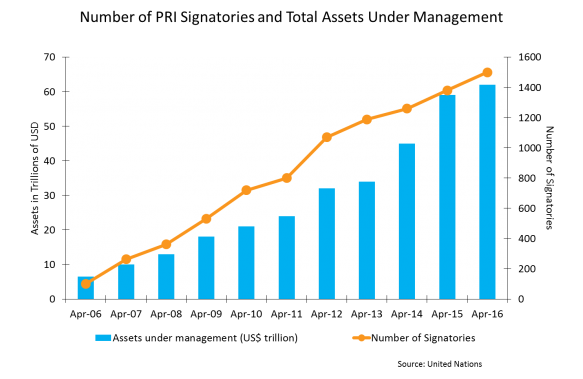

Index providers often work with large pensions and asset managers, so it’s difficult to surprise us with big numbers. Recently, though, I saw a chart with some staggering sums. I am pasting it below.

What is the PRI?

This chart shows the investment world’s adoption of the “PRI”, the Principles for Responsible Investment. In 2006, the United Nations, under the leadership of Kofi Annan, established six principles to serve as standards for how to invest. These are:

- Incorporate ESG issues into investment analysis and decision-making processes.

- Be active owners and incorporate ESG issues into our ownership policies and practices.

- Seek appropriate disclosure on ESG issues by the entities in which we invest.

- Promote acceptance and implementation of the Principles within the investment industry.

- Work together to enhance our effectiveness in implementing the Principles.

- Report on our activities and progress towards implementing the Principles.

The term “ESG” refers to “environmental, social, and governance” issues. These have developed into major themes in the investment and corporate world, and the PRI has become a leading initiative defining what these concepts mean.

As the chart shows, the PRI has been a remarkable success by certain measures. Companies managing over $60 trillion have signed the PRI. A full list of signatories can be found here. It’s possible that the company you work for has signed.

Criticisms and Support

Support for the PRI has been nearly universal. When companies sign up, they typically issue an announcement to congratulate themselves and to publicly support the project (see here and here and here). But the Principles have some critics. In 2013, some large Danish investors backed out of the PRI, for – ironically – lack of good governance by the entity overseeing the project.

Other criticisms I have heard at conferences and in other settings are that the principles are (a) too broad, (b) don’t require sufficient accountability, and (c) don’t actually result in change. The large number of signatories also raises this question. If 1,500 institutions with $60 trillion in assets can quickly sign up, how demanding can these principles be?

Moving Forward

These criticisms shouldn’t be dismissed, but they shouldn’t make us turn our backs on these Principles either. As Harvard noted when it joined, the Principles for Responsible Investment are part of an evolution, a “step” in the right direction that will result in professional investors striving to do a little better.

The posts on this blog are opinions, not advice. Please read our Disclaimers.