The municipal bond market is a huge and diverse segment of the bond markets. Part of the ‘lore’ of the muni bond market has been that the summer months of the year create a natural increase in demand for municipal bonds. It turns out there is a basis behind this ‘lore’.

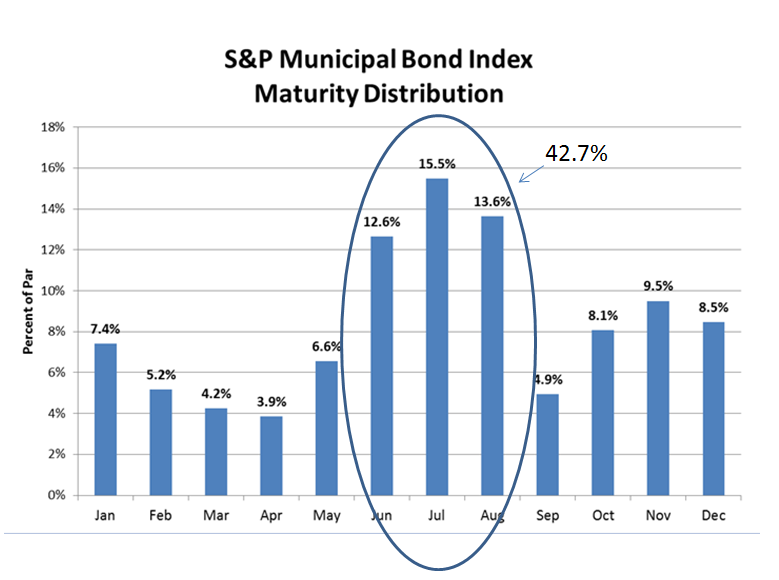

Using the broadest municipal bond index at S&P (and I believe in the muni market place), the S&P Municipal Bond Index and examining the concentration of debt maturing in each month gives us a visual of a ‘lunar’ like affect on the municipal bond market.

Some statistics describing the characteristics of the S&P Municipal Bond Index (as of June 10, 2016):

- Tracks over 91,000 bond issues

- Represents over $1.72 trillion in market value and $1.62 in par value

- Average coupon is 4.52% (par weighted)

- Average monthly interest implied is $6.2 billion (based on par value * coupon/12) but that is simply an average that does not take into account the ‘lunar’ cycle for municipals.

The ‘Lunar’ municipal cycle: By par value, 41.7% of the par value of debt matures in the months of June, July and August. Meaning their semi-annual coupons are paid in December, January, February, June, July and August. This creates a wave of coupon cash flow coupled with a concentration of bonds maturing in June, July and August that helps foster reinvestment demand for municipal bonds in the summer months.

Table 1: Monthly maturity distribution of bonds in the S&P Municipal Bond Index:

A key to understanding the impact of such a cycle is determining how much of that coupon and maturing bond cash flow is reinvested in the municipal bond market and how much is used to generate an income stream for it’s bondholders.

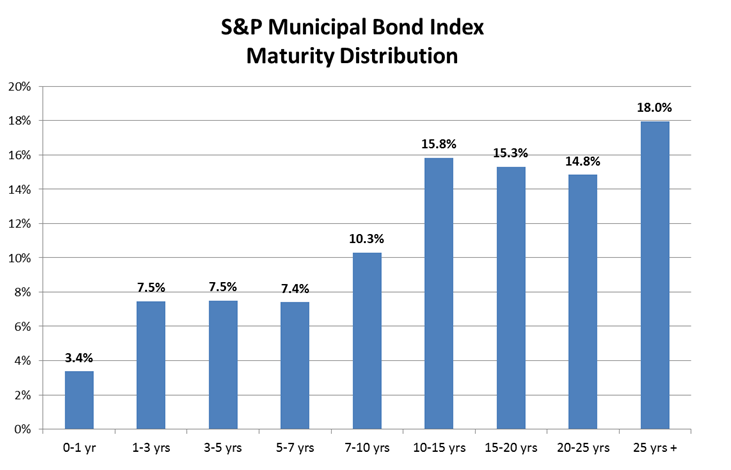

Another perspective is how much debt is retiring or maturing each year in the next few years. Other bond markets, like the high yield corporate and senior loan markets often have high concentrations of debt maturing in specific years in the near future – often referred to as a ‘maturity cliff’.

Table 2: Maturity distribution by par value of the S&P Municipal Bond Index:

The posts on this blog are opinions, not advice. Please read our Disclaimers.