In a previous piece, we highlighted the emerging credit risk in Chinese corporates. Nevertheless, a recent survey reinforced the belief in the long-term future of China’s onshore bond market and pointed to an expected increase in exposure to Chinese bonds.[1] As China’s bond market continues to grow, it may be important for market participants to identify high-quality corporate bonds.

Traditionally, market participants have used credit ratings to assess the creditworthiness of the borrower and as consistent standards so they could make comparisons across geographies and sectors. However, Chinese onshore corporate bonds are not typically rated by international rating agencies at the bond level; only selective issuer-level ratings are available.

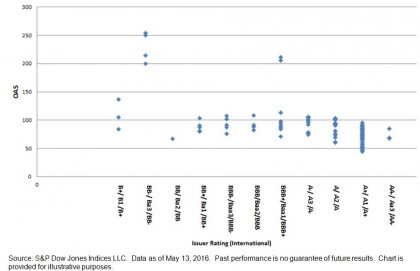

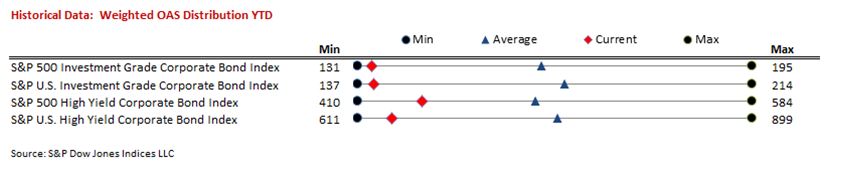

Using the S&P China Industrials Bond Index as an example, around 30% of the bonds that the index seeks to track is rated ‘AAA’ by one of the domestic rating agencies, and among those, only 22% are rated by international rating agencies on the issuer level. Looking at the industrial bonds that got both ‘AAA’ domestic ratings (bond level) and international ratings (issuer level), the credit quality observed varies largely; i.e., the international ratings ranges from ‘B+’/‘B1’ to ‘AA-’/‘Aa3.’ Exhibit 1 shows the range of option-adjusted spreads (OAS) across the international ratings (issuer level) for those industrial bonds, which further illustrates the broad diversity within the ‘AAA’ domestic rating band. In comparison, while Yanzhou Coal and China Shenhua both have ‘AAA’ domestic ratings and from the energy sector, Yanzhou Coal is rated ‘BB-’ by an international rating agency (issuer level) with an OAS around 250, and China Shenhua has an international rating (issuer level) of ‘AA-’/‘Aa3’ with an OAS of 70.

In response to concern related to the discrepancies between Chinese domestic and international ratings, we launched the S&P China High Quality Corporate Bond 3-7 Year Index, which is designed to measure higher-quality corporate bonds. In search of higher quality, we adopted a two-tier screening approach in our index design. First, issuers must be rated investment grade by at least one of the international rating agencies, and second, securities must be rated ‘AAA’ by at least one of the local Chinese rating agencies. Interestingly, the one-year total return of the S&P China High Quality Corporate Bond 3-7 Year Index was 6.61% as of May 16, 2016, outperforming its benchmark, the S&P China Corporate Bond Index, which returned 6.18% over the same period.

[1] Asian Bond Investor Survey from Finance Asia, June 2016.

Exhibit 1: S&P China Industrials Bond Index–International Rating (Issuer Level) Profile for ‘AAA’ Domestic Rating (Bond Level)