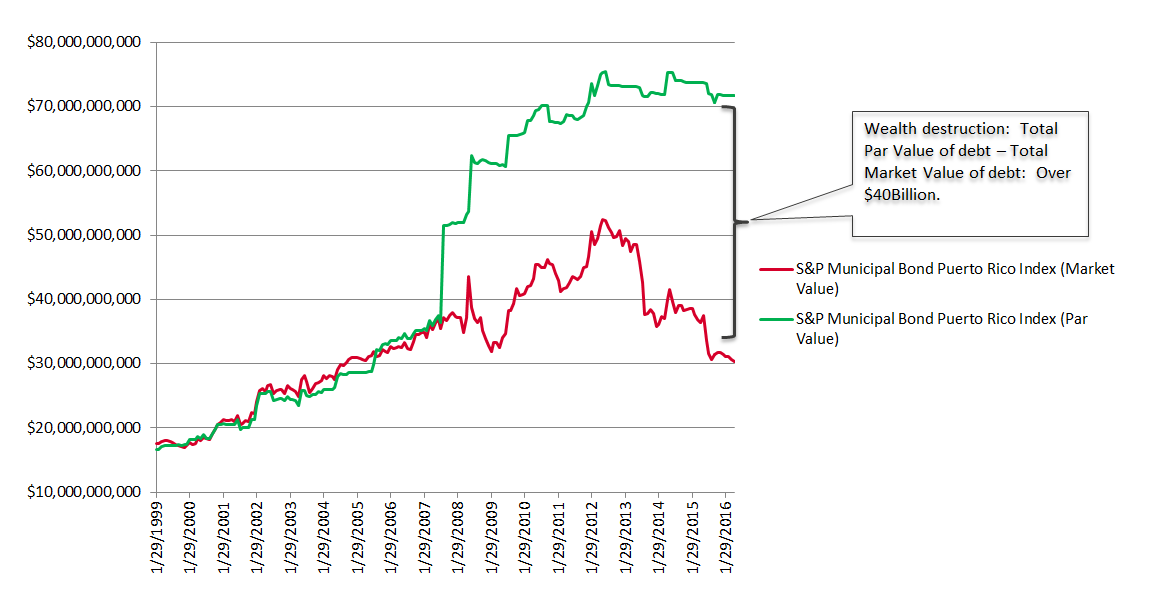

There is gap between the par amount and market value of Puerto Rico municipal bonds that has now broached over $40billion. While some of this can be accounted for as zero coupon debt, the fall in market value of the S&P Municipal Bond Puerto Rico Index is a startling reminder that credit and political risk can sting investors.

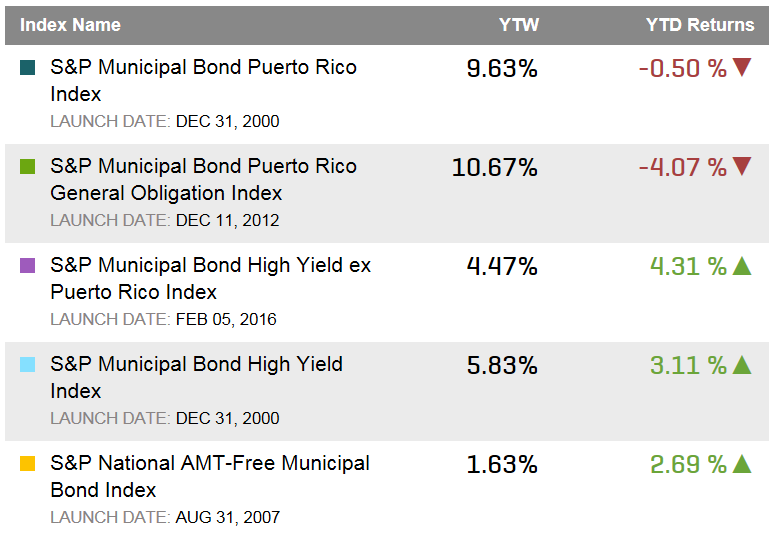

Year-to-date, Puerto Rico General Obligation bonds have returned a negative 4.07%. Meanwhile, high yield municipal bonds excluding Puerto Rico have been resilient. The S&P Municipal Bond High Yield ex-Puerto Rico Index has seen a total return (YTD) of 4.3%.

Chart 1: Total Par & Market Values of Bonds in the S&P Municipal Bond Index:

Table 1: Yields (Yield to Worst) and Year to Date Returns of Select Municipal Bond Indices:

The posts on this blog are opinions, not advice. Please read our Disclaimers.