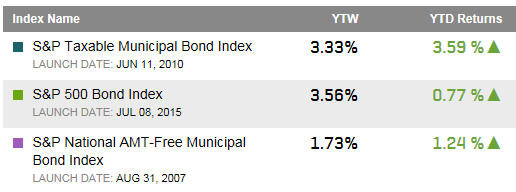

A detailed Wall Street Journal article today Markets in 2016: The Year of the Pig clearly shows that many asset classes are continuing to show volatility and negative returns however municipal bonds have been resilient. Tax-exempt investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index up 1.24% year-to-date and high yield municipal bonds tracked in the S&P Municipal Bond High Yield Index up 1.13%.

Taxable municipal bonds however have jumped ahead as the S&P Taxable Municipal Bond Index has returned 3.59% year-to-date. Relative to corporate bonds this segment of the municipal bond market has longer durations and higher coupons which both contribute to positive price movement as rates move down.

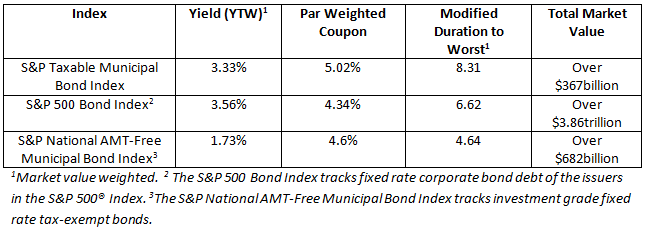

Table 1: Select bond indices, their yields and returns

Table 2: Select bond indices and key characteristics