2015 was a difficult year for emerging markets, as investors reduced their exposure to emerging markets and some shifted to developed markets. With concerns about a growth slowdown, a strong U.S. dollar, and the plunge in oil prices continuing to linger, some investors have remained cautious about allocating their exposure to emerging markets.

Looking specifically at the Southeast Asian local debt markets, there is evidence that they have shown resilience when compared with the equity markets; for example, the S&P BSE 500 (TR) climbed 0.45% in 2015, while the S&P BSE India Bond Index rose 8.40% in the same period.

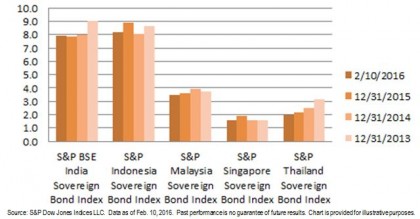

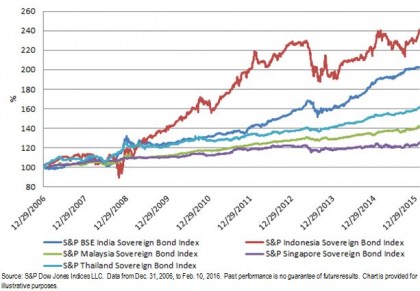

As tracked by the S&P Pan Asia Bond Index, the bond markets in Malaysia, Singapore, Indonesia, India, and Thailand all delivered positive returns last year. In fact, these countries have demonstrated robust growth trends since the index was incepted on Dec. 29, 2006 (see Exhibit 1).

Exhibit 1: Total Return Performance of the Southeast Asian Sovereign Bond Indices

Looking at index performance YTD, the S&P Indonesia Bond Index had a strong start and gained 4.54%, outperforming other Southeast Asian bond indices, which increased by 0.5%-1.5%. As presented in Exhibit 2, the yield-to-maturity of most countries has come down a bit in the past two years, which is in line with the global bond markets. As of Feb. 10, 2016, the yield-to-maturity of the S&P Malaysia Sovereign Bond Index stood at 3.49%, and its sovereign debt is rated as ‘A-‘ and ‘A3’ by Standard & Poor’s Ratings Services and Moody’s, respectively.

Exhibit 2: Current Yield-to-Maturity of the Southeast Asian Sovereign Bond Indices