As 2015 inches closer to the final bell U.S. municipal bonds are leading the returns as we near the halfway point of the final lap.

As of December 14th, 2015….

The S&P Municipal Bond Investment Grade Index has recorded a total return of 3.09%. Key factors for the muni market in 2016 include:

- Real new issue supply excluding refunding bonds could grow in 2016. This would be a welcomed sign for the muni market but will test the demand side of the equation.

- Demand for better quality municipal bonds has been strong and could remain strong in 2016.

- Defaults in the municipal segment are few but make powerful headlines. Puerto Rico remains the largest drag on the overall muni market. These events should support the higher grade portion of this market.

The S&P Municipal Bond High Yield Index has also shown positive returns of 2.51%. Key factors for the junk muni bond market in 2016 include:

- Puerto Rico resolution or steps toward resolution.

- Low real new issue supply of higher yielding municipal bonds helps keep the imbalance between demand for yield and supply off kilter.

U.S. Corporate bonds tracked in the S&P 500 Investment Grade Corporate Bond Index have just about returned 0% and the S&P 500 High Yield Corporate Bond Index has returned -4.68% so far in 2015. The market for these bonds in 2016 may be affected by:

- Expected lower new issue supply of investment grade bonds.

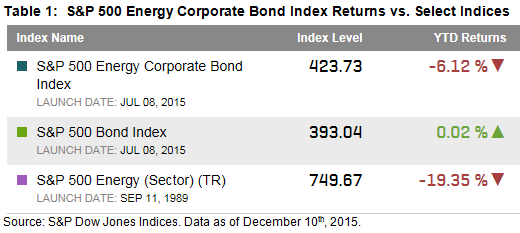

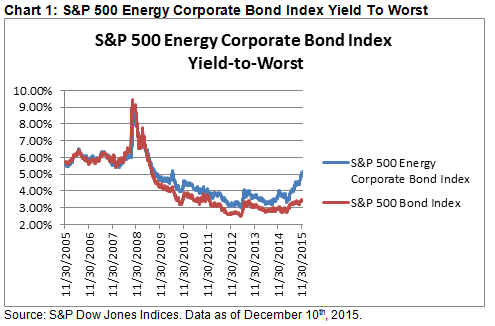

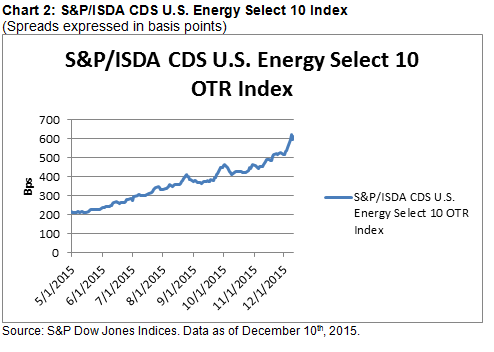

- A decline in the energy bond and mining related debt markets.

- Rising rates impacting the yield curve: i.e. flattening or steepening the curve. Expectations are that flattening is more likely.

- Credit spreads widening in the junk sectors.

Table 1: Select Fixed Income Indices Yields and Total Returns

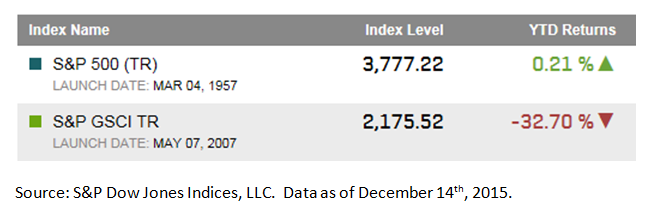

Table 2: S&P 500 and S&P GSCI Total Returns

The posts on this blog are opinions, not advice. Please read our Disclaimers.