The Fed’s policy makers, the FOMC, meet on December 15th and 16th and are widely expected to raise the target Fed funds rate for the first time since 2006. The odds of a 25 bp increase in the target range to 25-50 bp is about 77% based on Fed Funds futures. There are two key economic reports still expected before the meeting: employment and inflation.

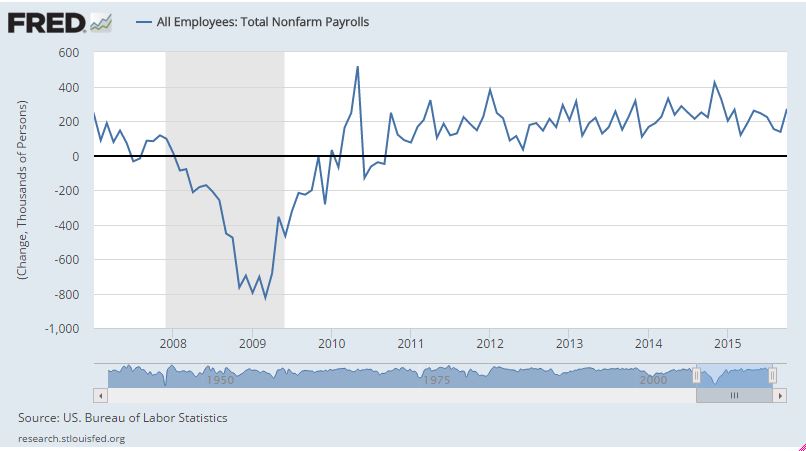

The first chart shows the monthly change in payroll employment since 2009. The market expectation is for a 200,000 increase, in line with recent numbers and further confirmation that the weakness seen in August and September is behind us.

The second chart shows the core rate for the CPI (CPI ex-food and energy). While the FOMC looks at a similar measure, the personal consumption expenditure deflator, the CPI is more widely followed and will be released on Tuesday, December 15th as the FOMC members gather for their meeting. It is expected to show inflation remains below the Fed’s 2% desired figure.

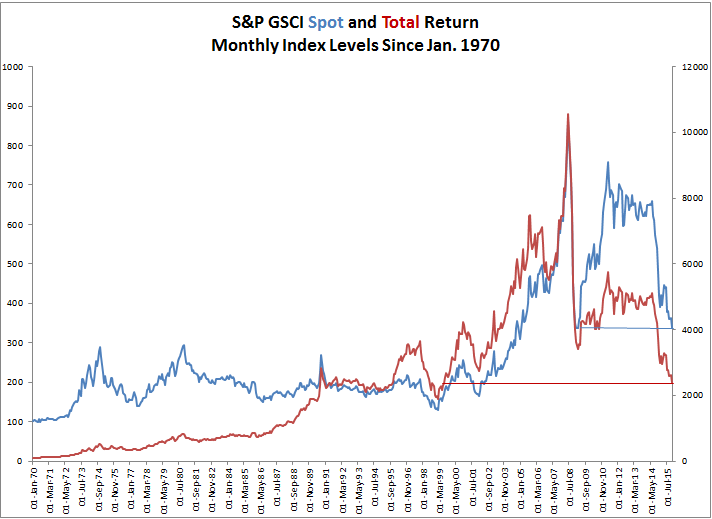

For those who wonder why there is so much interest in the Fed and a possible turn in interest rates, the last chart of the 10 year Treasury note yield is a capsule history of the bond market since the 1960s. We are nearing the end of what used to be called the “Great Intergalactic Bond Rally.” Once the Fed begins the shift to rising rates, it will be a different financial world.

The posts on this blog are opinions, not advice. Please read our Disclaimers.