Like in recent years, Greece has yet again dominated the European headlines for most of this year. Contagion effects have been somewhat contained, thanks to a more solid European economy and financial system. Nevertheless, the market has experienced bouts of heightened volatility, especially in June 2015 when the Greek authorities decided to shut their banks down to stem a potential liquidity crisis in the country.

Given this backdrop, we have decided to compile data on the 10-year performance of European active managers for the first time, and here are the results.

EUROPE

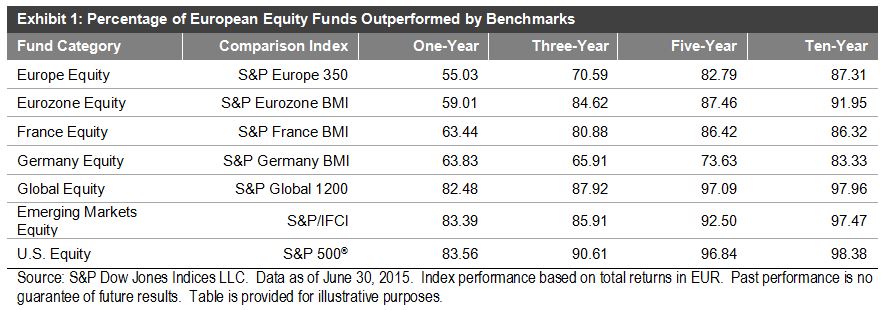

- Over the one-year period, 55% of the euro-denominated active funds invested in European equities lagged their respective benchmarks.

- This level of underperformance was even more acute over the longer term. When viewed over a 10-year period, about 92% of actively managed eurozone equity funds trailed their respective benchmark.

For more information, you can access the full report via this link.