Among analysts and Fed watchers, no matter what they expected from the Fed, they were all confident that this morning’s August Employment report would reveal the future. No luck.

If anything, the report had something, but not enough, for everyone. The increase in payrolls was 173,000, far below the 220,000 expected; the previous two months were revised upward by 44,000; the unemployment rate dropped to 5.1%, the lowest since 2008; average hourly earnings rose 0.3% after a string of 0.2% reports and average weekly hours beat expectations at 34.6 vs. 34.5. The treasury markets were as confusing as the report: at the release yields dropped – and then rose as people re-read the details.

With all the usual caveats of no guarantees and almost two weeks until the FOMC meeting, the odds slightly favor the Fed raising the Fed funds rate by a quarter-point. Set aside the top line payroll number for a moment and the rest of the employment report, and the economy, is solid. The unemployment rate dropped while labor force participation was steady, wages crept up and weekly hours were unchanged. Employment measured on the household survey rose by 196,000 jobs. Like all economic data, the devil is in the revisions. August payroll numbers tend to be low on the initial report but also tend to have large upward revisions. Altogether, the employment numbers favor a rate increase.

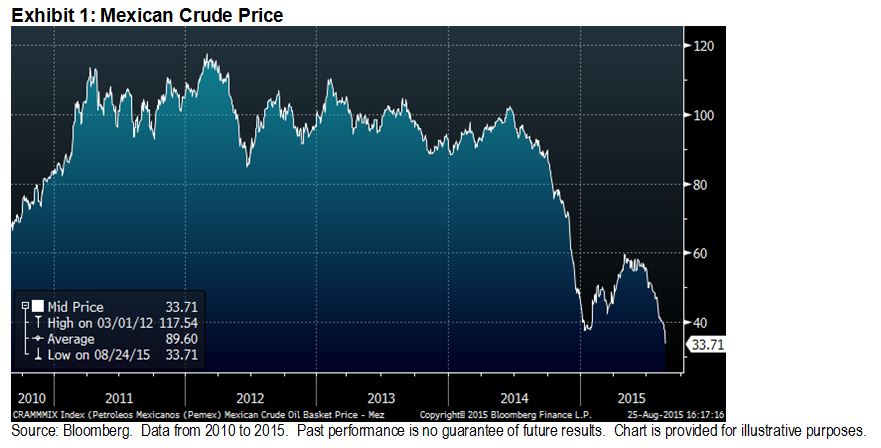

There are other factors favoring a September increase. As Stanley Fischer noted in his speech at the recent Jackson Hole meetings, if the Fed waits until inflation is clearly rising, it will have waited too long. But will inflation begin to rise? All oil prices have to do to remove downward pressure on inflation is to stop falling – and WTI has been in stuck between $40 and $60 per barrel so far this year. The speculation about the timing of the rate increase will continue to grow until the Fed makes a move. And attention is reaching extreme levels: Fed officials arriving for their conference in Jackson Hole last week were met by two groups of demonstrators – one for and one against raising interest rates. Senators, congressman and presidential candidates are all offering the Fed advice. All the noise will only get louder and louder until there is a rate increase. While lowering the noise level is not a reason to raise rates, giving the market clear signals of the long term direction is a good reason.

The turmoil in global stock markets is not an argument to wait before raising interest rates or an excuse to re-start quantitative easing. The Chinese markets were reacting to a weakening Chinese economy, rapid changes in Chinese government policies and attempts by the government to manage stock prices. The US markets were over-valued and due for a long awaited correction. While a rate increase is a negative for stocks, reducing uncertainty and getting passed the first move is a positive for the markets.

No guarantees, but a 60% change of a rate rise on September 17th.

The posts on this blog are opinions, not advice. Please read our Disclaimers.