Copper, the most important commodity in the world, has earned the title of “Dr. Copper” for predicting economic health. Today, TD Ameritrade ran an article claiming Dr. Copper Is In, questioning whether copper hinted last year at the current slowing global growth. While prior research shows Dr. Copper is not so smart, copper is still important and has some areas of specialties like inflation hedging.

Below is a recent Q&A with TD Ameritrade on Dr. Copper to drill into its role as the most important metal:

Why is copper such an important industrial metal? What are some of its uses world-wide?

Copper is the biggest metal in commodity indices with a greater world production and liquidity than any other metal. It comprises about 10.5% of the Dow Jones Commodity Index (DJCI) and just over 3% of the S&P GSCI. One-third of the DJCI is metals where the individual metals are weighted by average liquidity over 5 years. Inside the DJCI, copper is slightly bigger than gold and more than twice as large as the next biggest industrial metal, aluminum. The S&P GSCI is world production weighted where copper is about 1.5 times bigger than both gold and aluminum.

Copper has desirable characteristics as an industrial metal since it is malleable, a good conductor of heat and electricity, and is resistant to corrosion. This makes copper highly demanded for wiring and plumbing in construction, heating and cooling systems, electronic products and in automobiles. Further, it is an important metal in alloys such as brass, tin and with nickel. It improves malleability and acoustics for musical instruments plus does not corrode so is beneficial for shipbuilding.

Why does copper have a nickname: “Dr. Copper?” What is behind the idea that copper is an important predictive indicator for global economic activity?

Copper is reputed to have earned a Ph.D. in economics because of its ability to predict turning points in the global economy. This is since copper is so broadly used across industries from building construction, machinery, power generation and transmission, electronic product manufacturing and in transportation vehicles. The thought is as the demand for copper rises, its price likely increases and suggests a growing global economy. Conversely, declining copper prices may indicate sluggish demand and an imminent economic slowdown.

Who are the world’s top copper consumers?

China has the highest demand for refined copper that is about double Europe’s and roughly 4 times more than the US. The total global refined copper demand in 2014 was just over 20,000 MT with about half coming from China.

Source: http://www.businessinsider.com/copper-demand-by-region-2015-1

Who produces copper?

It’s estimated that Chile produced about 5.80 million tonnes or roughly 1/3 of the world’s copper in 2014. China, Peru, US, Congo and Australia are other big copper producers with 1.62, 1.40, 1.37, 1.10 and 1.00 million tonnes estimated in 2014.

Source: http://minerals.usgs.gov/minerals/pubs/mcs/2015/mcs2015.pdf

Copper prices have fallen significantly recently —what has been pressuring the copper market?

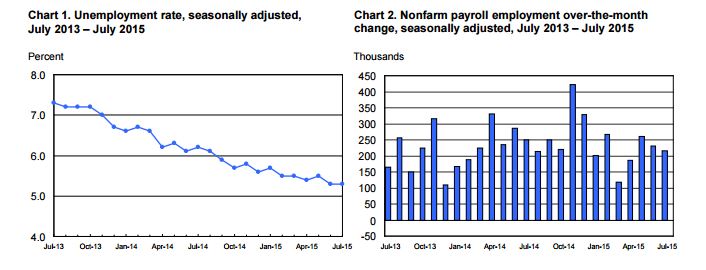

Many influences have been pressuring copper on the downside recently. There is uncertainty over China’s demand even though the numbers showed a 7% growth versus a 6.9% consensus. The fall in the Chinese stock market may also potentially hinder growth. This combined with the Greek crisis and increasing U.S. CPI (Consumer Price Index) has added strength to the U.S. dollar that is another headwind for copper, making it more expensive for buyers holding other currencies.

What if anything does the recent softness in copper prices reflect about global economic activity?

The stronger U.S. dollar exacerbates the softness in copper in addition to weak economic activity. Copper prices may reflect more weakness in the housing and construction industries and to a lesser degree the automobile sector, but it may not reflect as much about other areas of the economy. Also, the fall in oil prices in the past year has cut GDP growth for many of the oil producing countries that may slow the demand for copper as emerging countries take longer to develop. Finally, the supply side matters as adjustments may be made according to inventories and demand.

How important is Chinese economic growth to the copper market?

Considering China is the biggest copper consumer, Chinese economic growth is important to copper. However, on a per capita basis, Chinese consumption of copper is still only about half of North American consumption. This makes copper particularly likely to increase with increases in Chinese demand. Other factors on the supply side that may be seasonal, regulatory, or financial also influence the copper market.

What is the current supply/demand balance for the copper market? Is it a market out of balance?

Copper inventories been building, reaching short term highs. However, over the longer term, the 5-year LME Copper Stocks are still relatively low. The roll yield turned negative just this month indicating excess inventories; though on average for the year the roll yield is positive that measures shortages.

In Q1 2015, ICSG (International Copper Study Group) reported usage declining around 3% with a 4% drop coming from China. World mine production increased around 1.5%. In total, the world refined copper balance in Q1 adjusted for the change in Chinese bonded stocks indicates a production surplus of around 182,000 mt, compared with a deficit of around 70,000 mt in the same period of 2014, the ICSG said.

Does copper have a strong correlation to global GDP? Or does it have a strong correlation to any other economic trend or market?

S&P DJI research finds that Dr. Copper is not so smart. The supply side of copper is extremely important in its price formation so we find the historical correlation of copper to world GDP growth of only about 0.4. Further, it seems copper holds up well during weak recessions, up about 7% on average in weak recessionary years, but it only falls dramatically, about 30% on average in periods of strong recessions.

Copper returns are positively correlated to both expected and unexpected inflation, though the correlation to unexpected inflation is more significant. The sensitivity of copper to expected and unexpected inflation is relatively high with betas (or slopes of the regression) of 24.5 for expected inflation and 38.6 for unexpected inflation.

Please see more on our research at:

https://www.indexologyblog.com/2014/03/09/how-smart-is-dr-copper/#sthash.BtQwVI0f.dpuf

http://www.spindices.com/documents/research/research-taking-a-shine-to-copper-20120731.pdf

For stock traders, what information could that glean from watching the copper market?

Despite a ten-year annualized total return that is very similar as measured by the S&P GSCI Copper, up 8.4%, and S&P 500, up 7.9%, there is very little relationship between the two. The volatility of copper is about twice that of the stock market and the ten year correlation between copper and the stock market is only 0.196 and longer term back to 1977 is .0304. If anything, copper diversifies stock market exposure.