The CPI inflation rate in India rose as expected to 5.0% year-over-year in May 2015(from 4.9% in April), led by a higher crude oil price. The market is now expecting the Reserve Bank of India to remain on hold, in contrary to their expectation that most other emerging market policy rate decisions will have a more hawkish stance. This may contribute to the fact that Indian bond funds have recorded moderate inflows in the last couple weeks, as opposed to the outflows seen in most other emerging countries.

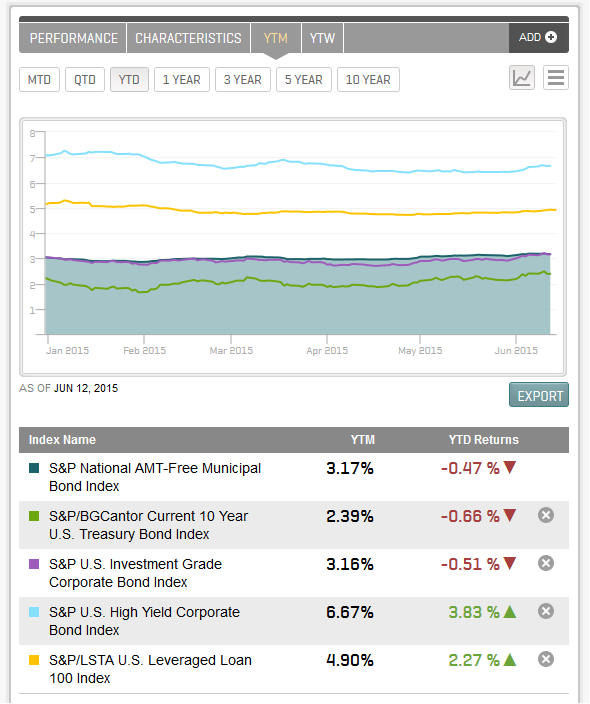

In fact, Indian bonds have remained resilient on the back of rising rates and the FOMC announcement. The total return of the S&P BSE India Sovereign Bond Index rose 2.70% YTD, compared with the 0.10% gain of the S&P BGCantor U.S. Treasury Bond Index (see Exhibit 1).

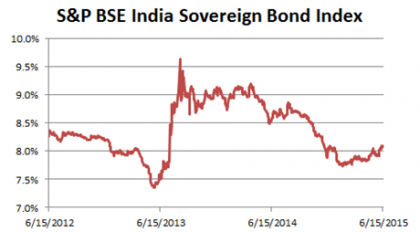

Also, the Indian sovereign bond index performance had a low correlation with the U.S. treasury market historically. The YTM of the S&P BSE India Sovereign Bond Index currently stands at 8.08%, which has widened seven bps YTD, (see exhibit 2). The rich sovereign bond yield may provide a cushion if global rates continue to edge up.

Exhibit 1: The Total Return of the S&P BSE India Sovereign Bond Index and the S&P/BGCantor U.S. Treasury Bond Index

Exhibit 2: The Yield-to-Maturity of the S&P BSE India Sovereign Bond Index