China continues to broaden foreign investor access to their onshore bond market. Luxembourg is the latest country being granted an RQFII quota by the People’s Bank of China, followed Canada, Germany, Qatar and Australia. According to the data published by State Administration of Foreign Exchange (SAFE) on April 29, 2015, the approved RQFII investment quota reached CNY 363 billion, representing a 22% increase from December, 2014. The number of the qualified institutions also rose from 93 to 121.

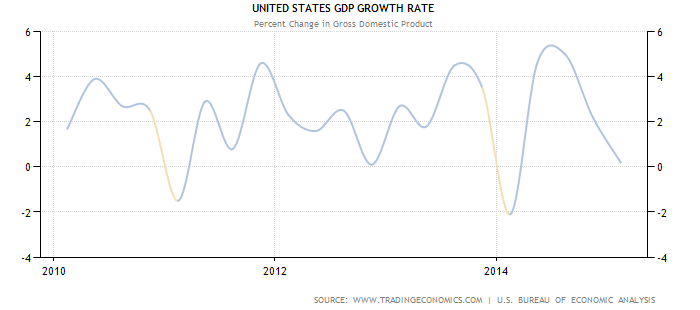

Among the qualified participants, Hong Kong remains to be the biggest player, with an RQFII quota allocation of around 74%, see exhibit 1 for the country breakdown. Outside of Hong Kong, the most significant development observed was by South Korea, with its approved quota jumping 10 times to CNY 30 billion, while the number of the qualified institutions climbed from 1 to 14 since last December.

In sync with the opening up of its capital markets, the China onshore market has recorded substantial growth in recent years. Tracked by the S&P China Bond Index, the market value of the China onshore bond market reached CNY 28 trillion, as of April 30, 2015. This market has expanded 22% since last year and more than three times since the index first valued on December 29, 2006. The market value tracked by the S&P Japan Bond Index, representing the other giant market in Asia, gained 2.6% and 37% respectively.

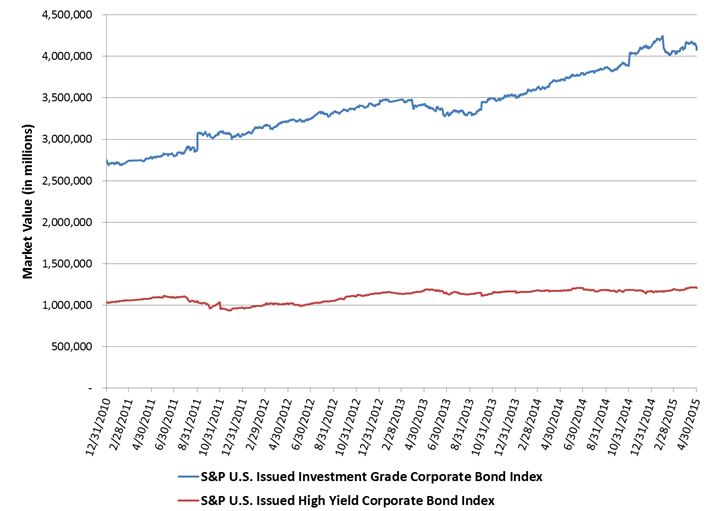

In terms of total return performance, the S&P China Bond Index rose 2.14% year-to-date (YTD), after a 10% gain in 2014. Global investors seem to continue to favor Chinese bonds as they offer relatively higher yields as compared to markets globally. The index’s yield-to-maturity currently stands at 3.91%, compared with 0.27% yield-to-maturity from the S&P Japan Bond Index. Please see exhibit 2 for indices comparison.

Exhibit 1: Country Breakdown of the Approved RQFII quota from State Administration of Foreign Exchange (SAFE)

Exhibit 2: Indices Comparison

| S&P China Bond Index | S&P Japan Bond Index | |

| Calculated Currency | CNY | JPY |

| Market Value | 7,866,324,806,704 | 1,119,159,373,390,670 |

| Yield-to-Maturity | 3.907% | 0.273% |

| 1-Year Total Return | 9.262% | 2.475% |

Source: S&P Dow Jones Indices. Data as of April 30, 2015

The posts on this blog are opinions, not advice. Please read our Disclaimers.

![Source:http://www.worldeconomics.com/papers/Global%20Growth%20Monitor_7c66ffca-ff86-4e4c-979d-7c5d7a22ef21.paper Real GDP data was taken from the World Economics Global GDP database Population data was obtained from the Maddison and the United Nations tables 2012/14 data was calculated from the year on year estimated % increase in real GDP from the IMF tables[1] (Gross domestic product, constant prices, % change)](https://www.indexologyblog.com/wp-content/uploads/2015/05/GDPyoyAmericas.png)