There is a Mexican saying about the weather, “Febrero loco, Marzo otro poco,” which means, “February is crazy and March is even more”. I didn’t think about applying this to financial markets until now, with the European Central Bank (ECB) announcement, economic data in the U.S., inflation in Mexico, and last but not the least, the Fed’s monetary policy announcement.

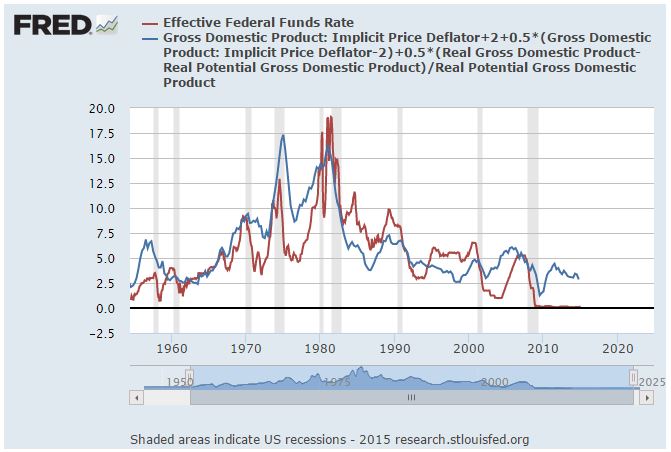

Having announced that the ECB will stimulate its economy through additional purchases, bonds have seen increased demand recently. Then, all eyes were on U.S. employment data, with the positive economic news that non-farm payrolls were up 25% more than expected (the estimate was for 235,000 jobs, and the actual level was 295,000). One business day later, Mexico published its CPI for February that showed a 3.00% annual change, versus the 3.03% estimate; remember, the objective of the Mexican Central Bank (Banxico) is between 2% and 4%. A few days ago, the Fed’s “patience” was over. The question is: will Banxico take action before or after the Fed? Looking at the CPI and level of the Mexican peso could point in that direction.

In March 2015, the Mexican 10-year reference bond has increased 25 bps to 5.88% from 5.63% (with a 19 bps average in the whole curve), with a closing high of 6.10% on March 10, 2015, with a 6.26% intraday level that day, causing the S&P/Valmer Mexico Government MBONOS Index to lose 0.97% (17.44% annualized). Real rates also have moved significantly in March 2015, increasing 24 bps and causing the S&P/Valmer Mexico Government Inflation-Linked UDIBONOS Index to lose 1.59% (28.55% annualized).

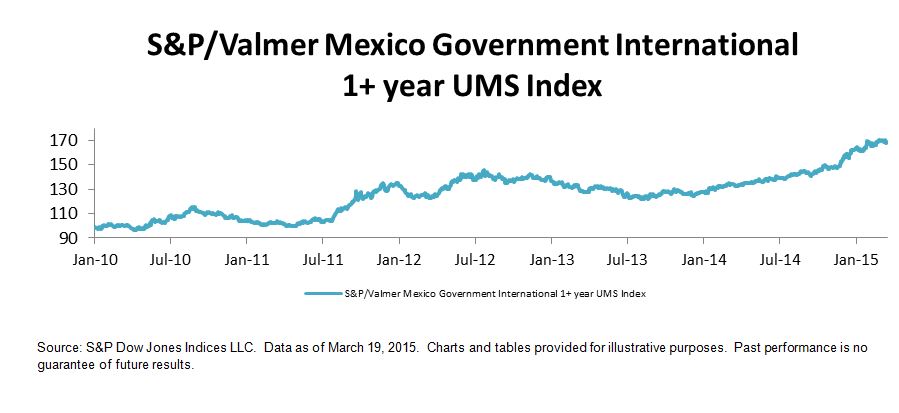

The Mexican peso has depreciated by 2.13% since the start of the month, from 14.95 to the March 19, 2015, close of 15.27. On March 20, 2015, the currency is down 1.52% (15.04). Continued currency depreciation of the peso means that the strength of the U.S. dollar has helped the return of the S&P/Valmer Mexico Government International 1+ Year UMS Index to be less of a loss, at 17.05% annualized.

Of note, this week’s auction of government bonds had its highest bid-to-cover ratio since November 2014; it seems that depreciation of the currency hasn’t stopped the inflows.

With all that is happening, don’t forget to watch the movements and thoughts of the analysts in the Banamex Survey of Economists was published on March 20.