If there is one thing that the large stimulus programs enacted by central banks in the U.S., U.K. and Japan over the past few years have taught us, it is that they provide a whopping boost to equity markets in the short term. Is that the only reason Europe is doing so well?

The European Central Bank announced its own €60bn per month bond purchasing program in January, and so far the S&P Europe 350 index of large-cap pan-European stocks has been having its best year ever. Our end-of-month European dashboard shows a total return of 15% for the first two months of the year; it also shows that every sector and every country represented in the index has gained.

But – as we have seen in Japan – the problem with a rising tide lifting all boats is that the performance of those boats becomes highly dependent on the tide. Otherwise said, if the stimulus program is all that is supporting the performance of European stocks, then as soon as it is priced in we return to a more volatile, uncomfortable market predicated on the ECB’s next move.

The good news is that this doesn’t seem to be the case. There are plenty of other reasons to be optimistic about European equities that have nothing to do with Mario Draghi. Lower energy prices should help the pockets of consumers and businesses, and most economists agree they should act to improve consumption. Less commonly appreciated, it is actually good news that German workers are striking for higher pay, following a generous deal already completed with the single-largest union. That’s seen as good news for two reasons: firstly because it helps to assuage fears of deflation, but also because the more expensive German workers are, the more competitive the rest of Europe’s labour force becomes. Finally, it seems that Greece, her government and their counterparts across Europe will continue to muddle through in compromise. The risks to markets of a “Grexit” are habitually overstated (Greek equities only account for about 0.2% of the market capitalization of the broad-based S&P Europe BMI), but the uncertainty has plagued markets for half a decade. From the perspective of sentiment as well as the long-term future of the euro – the outlook is more optimistic than it has been for some time.

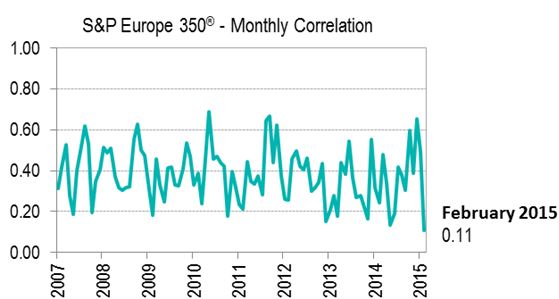

Yet, one can always find reasons to be cheerful, if you look hard enough. So is any of this important? Or do the ECB’s actions suffice to explain the performance of European stocks? It’s obviously hard to say definitively, but one way to seek an answer is to look at correlations. If, day-to-day, stocks have been moving up and down in concert and without respect to their individual circumstances, then it is reasonable to suppose that a shared theme was the dominant driver of performance. On the other hand, if correlations are relatively low then we might conclude that a widespread combination of factors has been germane.

The results are intriguing. Just before the turn of the year, the correlation figure for the S&P Europe 350 was recording three-year highs. So, in advance of the ECB’s announcement it might to be fair to say it was all that mattered. Since the announcement, however, correlations among European stocks have collapsed to their lowest levels on record. So the evidence points to a range of factors supporting the performance of European equities, beyond and above the stimulus. That might be another reason why so many investors are looking to Europe in 2015.

The posts on this blog are opinions, not advice. Please read our Disclaimers.