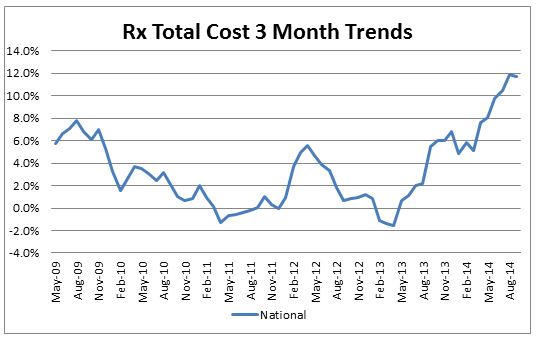

Although the overall medical trend rates covering all services have continued to be modest in the S&P data through the 3rd quarter of 2014[1], the prescription drug trends have been more volatile but modest prior to mid-2013, but have continued to accelerate since then through September 2014. On a 3-month basis they have climbed to 11.7% by September (before deductibles, copays, etc.). Cost pressure on generics and brand drugs (perhaps generated by price concessions on Medicare by the pharma companies) have shown an uptick in the last year, however, the introduction of Sovaldi and other new and expensive drugs in early 2014 (which are now incorporated in our economic forecasts) are further pushing up drug costs. Furthermore, the impact of deductible/fixed dollar copay leverage can be quite substantial on drug plans and have pushed drug trends to insurers even higher than shown in our forecast worksheet. The impact of more new and expensive drugs for cancer, cardiovascular and cholesterol in 2015 can be expected to potentially push trends higher than the economic forecasts in our models until it gets completely factored into the data. Recent anecdotal data seems to indicate that Sovaldi growth may have peaked in the short term, while patients are waiting for the new alternative product Harvoni. In addition to the high cost of Sovaldi, there are issues about the required additional drugs, and the somewhat higher drug regimen termination rates than in initial trials of the drug that could be causing a slowdown in its prescription rate. A number of combination drugs for Hepatitis C were expected to become available starting in 2015 that help reduce some of the negative effects mentioned, and some patients may be holding off for these new options.