Everyone wants an explanation. Cataloged below are popular explanations with each rated as plausible, contributing, possible, or unlikely.

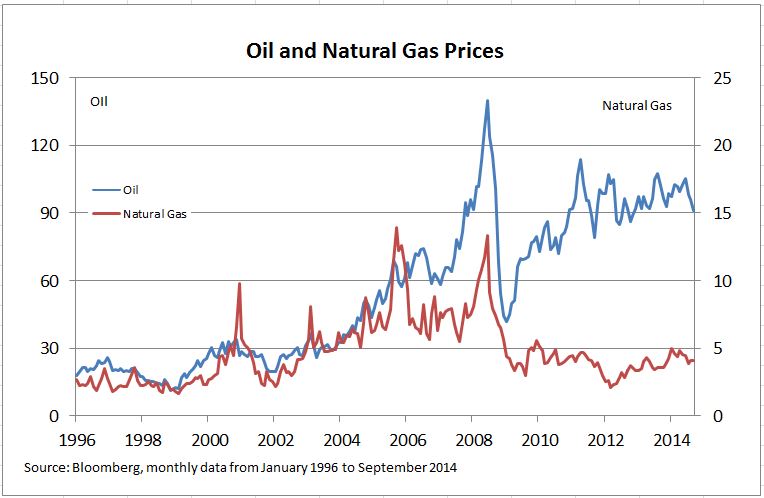

Falling oil prices – bad news for energy stocks but good news for the rest of the economy, especially for consumers. A few years back everyone was wishing for cheaper gasoline and now that it is almost here we blame it for falling stock market. Contributing

Slow growth in Europe and recession risks in Germany – Europe’s economy is barely growing and near term prospects suggest further weakness. Everyone likes what the European Central Bank says, but no one believes it can provide enough monetary stimulus to make a real difference. A German recession would hurt the rest of Europe, dampen some of the US economy’s strength and deter some pending tax inversion M&A deals. Plausible

China — In China 7.5% real growth is slow, and it is likely to get slower still. China faces both short term and long term economic challenges and sorting them out won’t happen overnight. Exports are likely to continue and there will be new cell phone models in 2015, but China may no longer be the buyer of last resort for all natural resources. The direct impact on the US markets is less than the risk of a European recession, but China is certainly a contributing factor

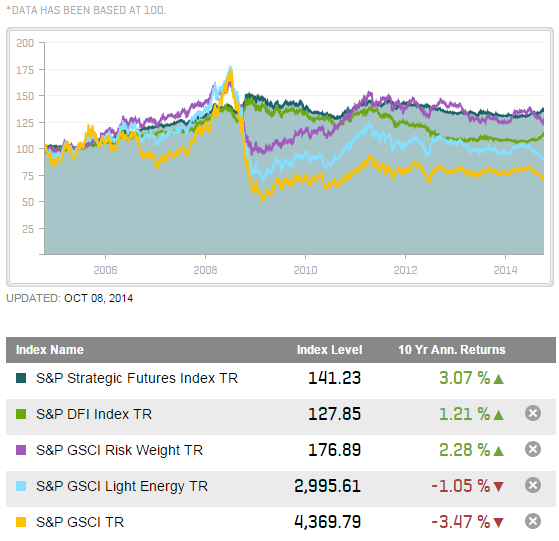

The end of QE – When the Fed began quantitative easing everyone said it was a mistake. Then everyone said it raised asset prices, including stocks. Now that it is ending, everyone is worried what happens when it goes away. The announcement and the associated anxiety do more damage than QE itself. We survived the “Taper Tantrum” last year and will survive the final end of QE, which, by the way, is almost gone. Unlikely

The Fed – Setting aside QE, some investors always blame the Fed, either for what they did, or didn’t do. Over the weekend Stanley Fischer, the Fed Vice-Chairman suggested that economic weakness in Europe and emerging markets might lead the Fed to delay any interest rate increases. For the moment, the Fed is not the problem. Unlikely

Geopolitics, Ebola, and ISIS – All these worry people and those worries combine with the market worries to encourage selling. If ISIS were routed, Ebola was only found in bad thriller novels and no one wanted to sanction someone, would a 5% market pullback make the six o’clock news? Plausible

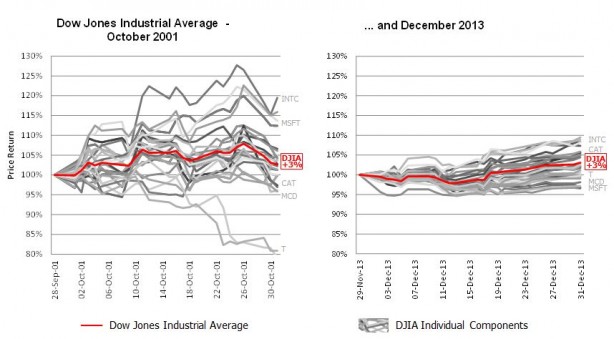

The S&P 500 is falling – Can we blame that market’s decline on the market? One factor cited by market analysts is that the S&P 500 has fallen far enough to test its 200 day moving average. In research done following the 1987 stock market crash, Robert Shiller asked investors what factors they cited for the market crash; their response was the sharp declines the week before the crash. Crowd psychology plays a part. The title of one of first analyses of markets and manias was Extraordinary Popular Delusions and the Madness of Crowds. Contributing

Do we know why the market is down? No. Maybe there isn’t an explanation. The US economy is doing okay – unemployment is down, inflation is low, there are hints that wages may be rising and the economy is growing. This is the fourth time this year the S&P 500 dropped about 100 points. The market has successfully forecasted about seven of the last two recessions. Remember that the market will fluctuate and is virtually unpredictable.

The posts on this blog are opinions, not advice. Please read our Disclaimers.