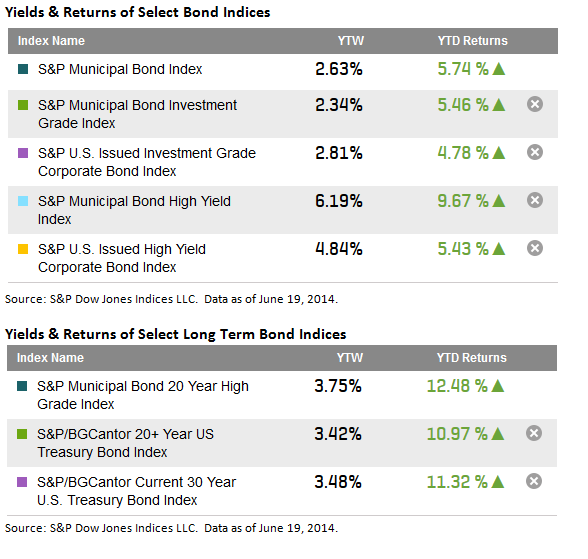

The S&P Municipal Bond Index has returned 5.74% year to date as yields have remained relatively stable as the market absorbs new issue supply. High yield municipal bonds tracked in the S&P Municipal Bond High Yield Index have continued to outperform their corporate junk bond counterparts by returning 9.67% year to date. As the yields for U.S. corporate junk bonds has hit lows well below 5%, municipal high yield bonds in the S&P Municipal Bond High Yield Index have remained over 6%.

- Longer dated municipal bonds have outpaced U.S. Treasuries with the S&P Municipal Bond 20 Year High Grade Index returning 12.48% year to date. The 3.75% tax-exempt yield of these bonds remains over 25bps cheaper than the 30 year U.S. Treasury Bond.

- Tobacco settlement bonds have rallied all year as the S&P Municipal Bond Tobacco Index has returned over 13.2% as yields have fallen by over 100bps to end at 5.9%.

- Puerto Rico General obligation bonds may have hit a ceiling in their 2014 rebound. The S&P Municipal Bond Puerto Rico General Obligation Index has returned 9.86% year to date after losing ground over the last week as yields have risen on average by 10bps.