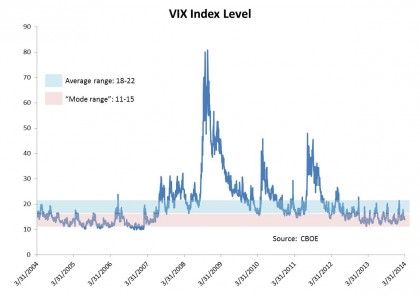

This morning’s Wall Street Journal reports that “Investors are piling into the shares of small, risky companies at the fastest clip on record, in search of investments that promise a chance of outsize returns….” We’ve commented on such risk-seeking behavior earlier, because it has an important bearing on the low volatility anomaly.

The tendency for low-volatility or low-beta portfolios to outperform market averages has been the subject of at least 40 years of academic and practitioner research. Given its challenge to what “everyone knows” about risk and return, a number of explanations for the low vol anomaly have been advanced.

Our favorite, the so-called “preference for lotteries,” comes from the realm of behavioral finance. The expected value of buying a lottery ticket is negative — so under the assumptions of classical economics, no one would ever buy a lottery ticket. But this misses a broad swath of reality. The behavioral explanation is that some people are willing to risk a known sum in exchange for the possibility, remote though it may be, of becoming humongously rich next Tuesday.

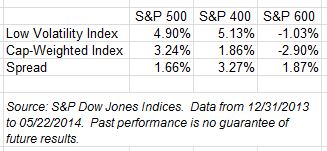

What’s the analog of a lottery ticket in the stock market? The market’s lottery tickets are the shares of highly volatile, untested companies — exactly like the penny stocks cited by the Journal. When investors pay up to buy volatility for volatility’s sake, it creates an opportunity for those who take the other side of their trades. We see this in the results of our low volatility indices so far in 2014:

It may appear paradoxical that low vol strategies are doing well when interest in speculative, penny-stock strategies is growing. What behavioral finance tells us is that the two occurrences aren’t contradictory — in fact, one may be driving the other.

The posts on this blog are opinions, not advice. Please read our Disclaimers.