After a strong 2013, the US equity market took a dive in January 2014 and dropped more than 3%. Is it a temporary market correction or something more substantial? Everyone has his own answer. Regardless of your outlook of the market, January has reminded us that market volatility is still one of the major risks that investors have to take care of.

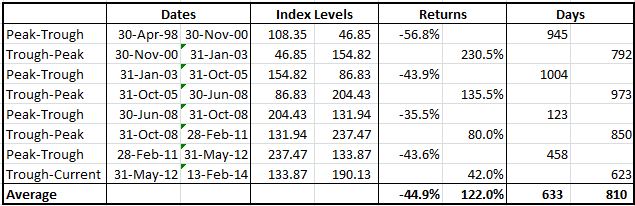

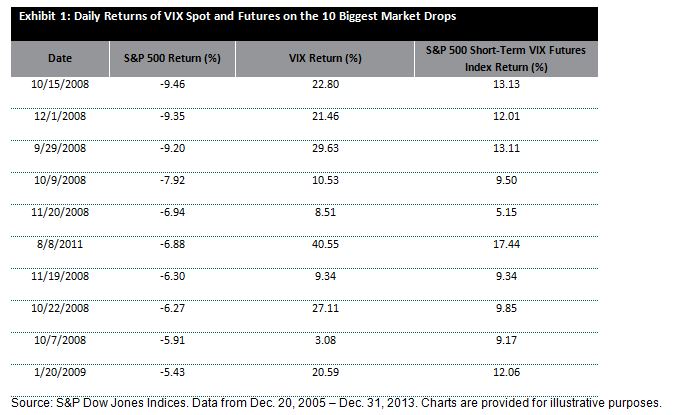

To directly hedge against equity market risk, investors traditionally buy put options to protect their downside. In recent years, more and more investors include VIX derivatives in their portfolio to manage their market risk, including VIX futures, options, exchange traded products and other OTC products. The main benefits of using VIX derivatives are: 1) VIX is negatively correlated (~ -77%) with the S&P 500 Index historically, and 2) this negative correlation is convex, meaning that VIX shows more reaction to large decrease in the equity market than to market increases. Exhibit 1 shows that rises of the S&P 500 VIX Short-Term Futures Index were usually higher than the losses of the equity market when the market was in stress.

Isn’t convexity a nice feature of VIX futures? Unfortunately it is no free; VIX futures can lose money even if VIX does not change. All futures have fixed expiration days; hence the S&P 500 VIX Short-Term Futures Index has to roll from the first month futures contract to the second month futures contract prior to the expiration on the first month contract. Since Dec. 2005, for the majority of the time (~ 83%), the longer term VIX futures were more expensive than the shorter term futures and a roll cost was incurred.

This roll cost of VIX futures is equivalent to the upfront premium for equity put options. It is the price of the downside protection. The only difference is that the roll cost is distributed throughout the month as the futures price converges towards the spot while the put option premium is paid up front.

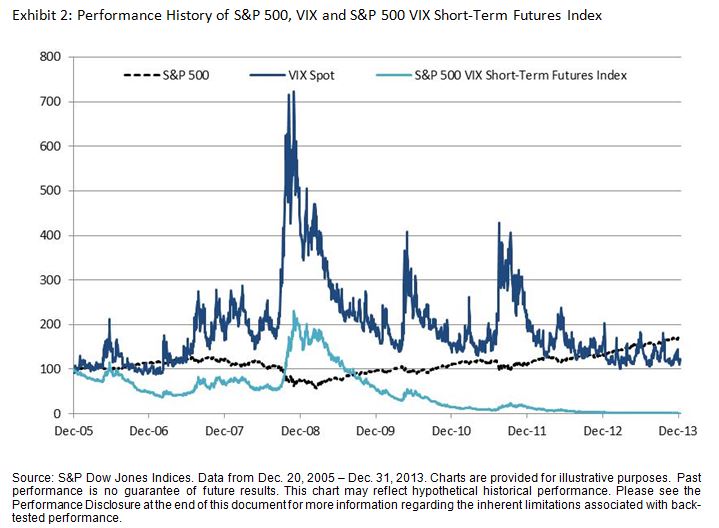

Exhibit 2 shows that the roll cost has led to significant performance drag in the S&P 500 VIX Short-Term Futures Index.

Exhibit 2: Performance History of S&P 500, VIX and S&P 500 VIX Short-Term Futures Index

To avoid paying too much for downside protection, investors have to adjust their allocation to VIX futures wisely and implement “just-in-time hedging”. To help investors to dynamically allocate to VIX, S&P Dow Jones Indices launched the S&P 500 Dynamic VEQTOR Index (“VEQTOR”) as a prepackaged investment solution. The Index monitors two market signals, implied volatility trend and realized volatility, and allocates dynamically to equity and volatility. It also has a “stop-loss” feature that moves 100% to cash when the index has experienced more than 2% loss in the past five business days.

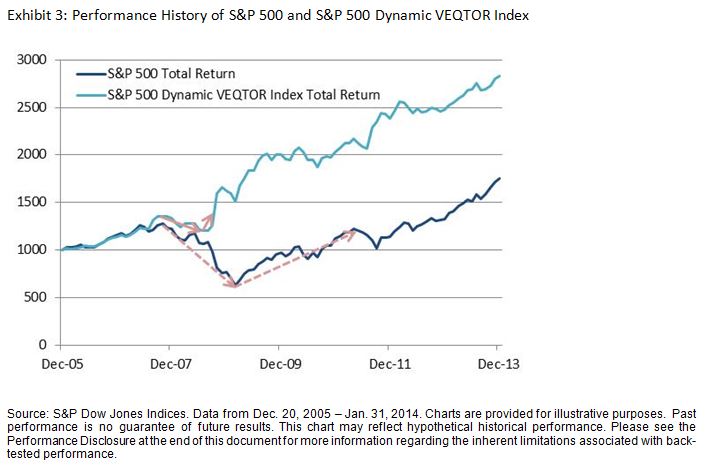

Compared to S&P 500, VEQTOR shows lower maximum drawdown and faster recovery. On 3/9/2009, the S&P 500 dropped 55% since its previous peak (2447.08 on 10/9/2007). It took 1120 calendar days to recover (2449.08 on 4/2/2012). VEQTOR saw its maximum drawdown on 9/15/2008 when it dropped 18% since its previous peak (137005.24. on 10/9/2007). It took only 31 calendar days to restore that level (140308.26 on 10/6/2008). See Exhibit 3.

As all volatility reduction products, VEQTOR outperforms in bear market. It also participates in the growth but underperforms in strong bull market.

For more information, please join us during our webinar on Thursday.

The posts on this blog are opinions, not advice. Please read our Disclaimers.