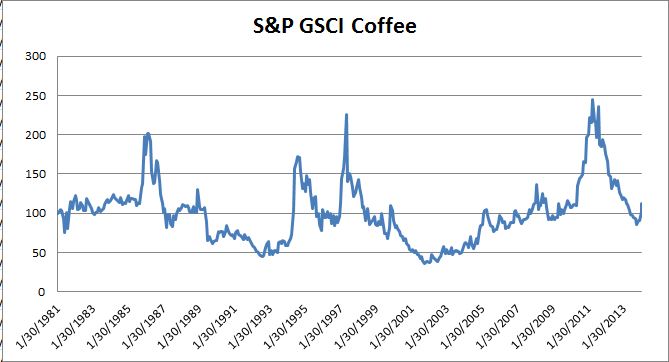

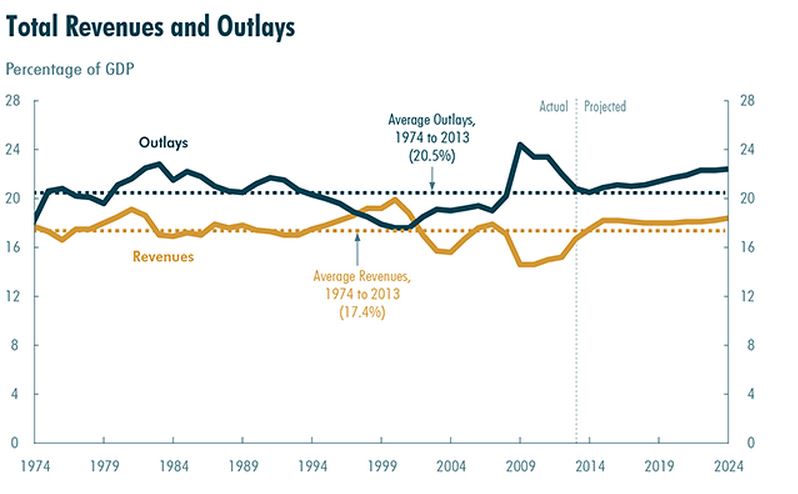

The Congressional Budget Office (CBO), the government’s bi-partisan budget researchers released its latest report and projections for the federal budget deficit. The deficit is back to the average percentage of GDP experienced since 1974. The bulge in spending and the drought of revenues caused by the financial crisis is behind us. The chart shows that the current gap is back to its average.

Fiscal policy – using taxes and spending adjustments to help guide the economy — has been pretty much off limits in recent years because the financial crisis pushed the federal deficit to almost 10% of GDP in 2009. That was the highest level since the second world war when, with a largely controlled economy, the deficit was close to 27% of GDP in 1943. This doesn’t mean that we can spend like it was 2008 again. In fact the CBO analysis points to a rise in the deficit as a percentage of GDP in another couple of years. The “culprits” are an aging population, social security and health care spending.

There was other encouraging news about the deficit: the House of Representatives agreed to raise the debt ceiling through March 2015 without any conditions. This means that citizens and investors will be spared battles and grand-standing about government shutdowns for a year. A couple of words about the debt ceiling: First, the deficit is not the same as the debt. The deficit is the difference between government revenues and spending – if the government spends more money that it collects with taxes and fees, there is a deficit. It borrows money to make up the difference instead of stopping its spending (although there are some politicians who would like it to just stop spending no matter who wouldn’t get paid.) The money the government borrows is the debt. Some time ago, Congress began to worry about the growing government debt, even though the growth of the debt was due to laws for spending and taxes passed by Congress. So they passed a law to put a cap on the debt. Now, whenever that cap is hit by growing debt the Congress debates and then raises the cap. If the cap weren’t raised, the US government wouldn’t be able to borrow to pay its bills,

Hopefully the recent progress on the deficit may inspire Congress to focus on spending, taxation and fiscal policy instead of the debt ceiling

The posts on this blog are opinions, not advice. Please read our Disclaimers.