As 2013 is wrapping up and we look out to 2014, there are some key questions about the drivers and opportunities in commodities in the coming year, as discussed in this interview.

Below are some of the questions discussed PLUS a bonus question about metals.

Q1: Jodie, let’s talk about commodity performance in 2013. It looks like the S&P GSCI is off about 1.9% (ytd through Dec 18, 2013) and the Dow Jones UBS Commodity Index down 9.3%. What market events pushed down the performance of these indices this year? Given the commodities in each of the flagships is roughly the same, the most important factor for the performance difference between the indices is the weights. Energy has been the only positively performing sector, up about 5%, which has really helped the S&P GSCI with about 70% of its weight in energy. Agriculture, which has the second heaviest weighting in the S&P GSCI of about 15% lost 17% in 2013, led by corn and wheat, both in bear markets, down 29% and 27%, respectively, led by favorable weather and a stronger U.S. dollar. However, from the different weighting scheme of the DJ-UBS, metals were the main culprit, led by gold. Gold lost 30% in 2013 on stronger sentiment about an economic recovery and has the biggest target weight in the index of over 10%. My last point about how much the constituents and weights matter is demonstrated by POSITIVE performance this year from the S&P World Commodity Index (WCI) that is ex-US. It has 22 commodities across eight international exchanges and is world production weighted, just like the S&P GSCI. While it was only up slightly, about 1%, it was the European commodities, led by Brent crude oil, that pushed the index into the black.

Q2: What type of head winds might the commodity market run into or continue to run into in 2014? Although commodity performance was largely negative in 2013, the severity was light for the risks that were and continue to be in the market. The Chinese demand growth stayed on target, the U.S. did not default on its debt or fall off the fiscal cliff, and major crises were avoided in the Eurozone. By now, it even seems that while the Fed tapering and Chinese demand growth are still hot topics for commodities as we enter 2014, the geopolitical environment like the Syrian tensions have overtaken the attention of the Eurozone crisis as a top driver of commodity performance.

Q3: What potential impact, if any, will the US oil production revolution have on the commodity markets and international oil prices? If the production grows more quickly than the technology and logistics can to transport it, then there may be inventory excess and price pressure like we’ve seen in WTI. What is more important to the indices about the U.S. energy revolution is how the weights are impacted. From 2011-2014, the combined weight of WTI in the S&P GSCI and DJ-UBS has dropped by about 15% and has been mostly replaced by Brent.

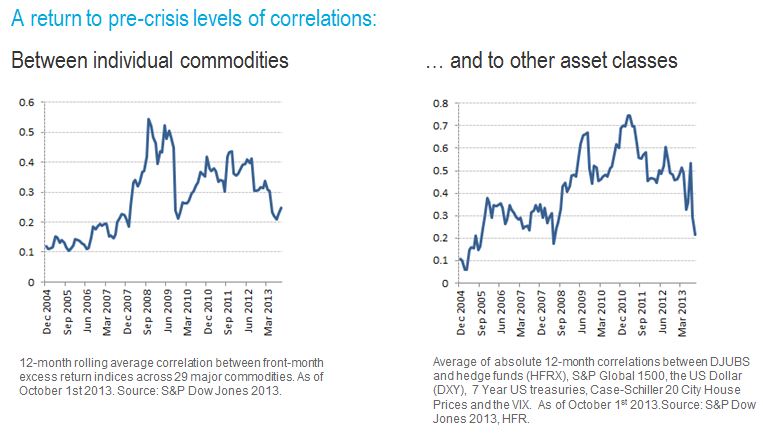

Q4: Jodie, despite difficult returns this year, we’ve seen a mini-revival in commodity investing by pension funds and growing interest by individual investors. What are some of the reasons for this and do we expect this trend to continue next year? The main reasons investors are turning to commodities are the same as throughout history, which are diversification and inflation protection with the potential of equity-like risk and returns. Although these reasons hold in the long run, many investors questioned the true diversification commodities provide since they fell in the financial crisis with each other and the other asset classes. The risk-on/risk-off environment has proved difficult for commodities, especially as portfolio diversifiers to protect capital. Today, there are new factors overtaking the risk-on/risk-off environment that are bringing down correlations to pre-crisis levels, which you can read more about here:

As suppliers have reduced production post-financial crisis and inventories have been reduced, finally the supply shocks, are driving commodity returns again and cause them to be different from each other and from equities and fixed income. This is creating the most opportunity for spread plays and diversification since 2007.

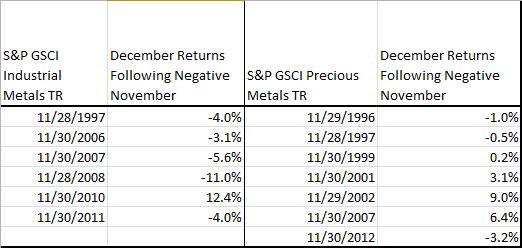

Bonus question: Will metals continue their downfall? The interesting thing about metals is the difference between the industrials and the precious metals. Since 1995, there were 6 Novembers where industrial metals had negative returns and 5 out of those 6 times there was a negative December following. This is not surprising given the sensitivity of industrial metals to the inventory situations. Given the more difficult storage situations of some industrials like copper, it may be difficult for suppliers to meet the demand so the equilibrium is balanced by price, causing a persistent trend. [The possible reason for the persistence in realized roll yield may be, as discussed in Till and Eagleeye (2005), “if there are inadequate inventories for a commodity, only its price can respond to equilibrate supply and demand, given that in the short run, new supplies of physical commodities cannot be mined, grown, and/or drilled. When there is a supply/usage imbalance in a commodity market, its price trend may be persistent….“ ]

On the other hand, precious metals, which are well supplied and easy to store, have had 7 negative Novembers but only 3 of the following Decembers were down.

Different fundamentals that are more aligned with their “store of value” qualities like central bank buying and flight to safety, drive the precious metals. Since the precious metals are largely abundant, there is less trending from price as the calibrating factor to balance supply and demand. Overall, it is not surprising that in all calendar months over the time span Jan 1995-Nov 2013, that industrial metals moved in the same direction as in the prior month 51% of the time, but precious metals only moved in the same direction as in the prior month 46% of the time.

The posts on this blog are opinions, not advice. Please read our Disclaimers.