At S&P Dow Jones Indices, our research indicates that indexing small-cap and mid-cap stocks works as well as it does for large-cap stocks, even though the large-cap segment may be more efficient than its junior siblings. Nevertheless, the popular belief that indexing works better for large-caps is well-entrenched and widely endorsed by advisors, consultants, and other financial professionals.

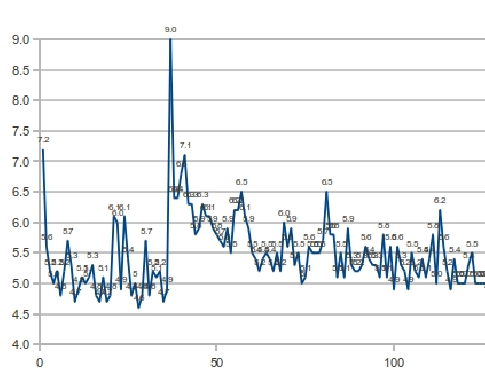

A look at active fund performance through time, as excerpted from our July 2013 Persistence Scorecard, sheds light on why indexing works irrespective of market efficiency and is at least as effective for small-cap and mid-cap exposure as for large-cap. The figure below depicts performance results over two non-overlapping three-year periods for active funds that achieved first quartile status after the first period.

- While 23.2% of top quartile small-cap funds stayed in the first quartile after a second three-year period, almost a third (31.3%) fell to the fourth quartile.

- Over 1 in 10 (about 11.7%) first quartile small-cap funds were either merged with another fund, liquidated, or changed investment style (diverging from small-cap exposure).

- An equal proportion of first quartile mid-cap funds remained in the top quartile and fell to the bottom quartile (17.6%).

- Over 1 in 3 (about 33.8%) first quartile mid-cap funds were either merged with another fund, liquidated, or changed investment style. The large proportion (20.3%) diverging from mid-cap exposure seems to be unique to the mid-cap space. These managers may have more of a tendency to drift upwards or downwards in capitalization focus within their portfolios than large-cap or small-cap managers do.

- Active large-cap fund performance seems more uniformly distributed from period to period – with more equal proportions of top quartile funds subsequently finishing in second through fourth quartiles. This behavior could be related to market efficiency because higher information levels characteristic of large-cap stocks could drive less differentiation between active funds’ performance; i.e., they inherently may have less active risk.

Contrary to popular belief, the potential inverse relationship between market efficiency and active risk may be good reason to index small-cap and mid-cap stocks. Indexing has shown it can reliably deliver market returns and remain style consistent, whereas investing in active small-cap and mid-cap funds may result in overshooting markets during some periods, undershooting in others, altering style unpredictably, and generally compounding total risk without commensurate reward.

The posts on this blog are opinions, not advice. Please read our Disclaimers.