Picking the right ETF among the hundreds that are currently available is certainly a formidable task for many investors – one that has been made more difficult by iShares recent announcement that it is removing index names from a number of its ETFs. Why should this raise concerns for investors and for the financial industry overall? Well, simply stated, it’s a transparency issue. As investors will no longer be able to determine the index that underlies an ETF just by looking at the ETF name, investor transparency has taken a few steps in the wrong direction.

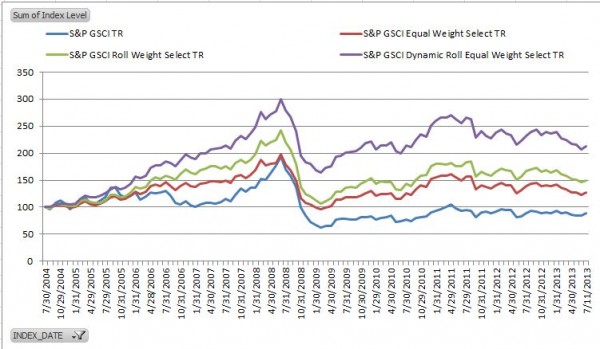

As we have seen with the issues facing LIBOR and Reuters/WM, transparency of indices has become a paramount theme for investors. Knowing your exposures and where your potential returns are coming from are vital pieces of information that every investor should be aware of. As a recent Index Universe article pointed out, “the underlying index choice is the single biggest determinant of your returns”, and I couldn’t agree more. Given the growing number of indices available in the marketplace (S&P Dow Jones Indices, itself, calculates and publishes over 830,000 indices) – each with different weighting schemes, components, rebalancing schedules, and stated objectives – it’s absolutely critical that investors know what they are buying when they decide to invest in an ETF.

But what about the index provider? Finding the right index that underlies your ETF is one important step in the process, but knowing the index provider responsible for calculating and publishing the index underlying your fund is another. Does the index provider have a considerable track record in producing stock market indices, is it independent from the product, does it have a team that monitors the index 24/7, does it have a dedicated customer service department, are its benchmarks free of conflicts of interest, is it known for consistently and reliably producing indices, has it secured the necessary data licenses to ensure the ongoing calculation of the index, and does it utilize a transparent system comprised primarily of independently sourced pricing? With over 125 years of experience producing uncompromised indices and benchmarks, S&P Dow Jones Indices has worked tirelessly to ensure that our brand meets all of the above criteria while consistently and reliably serving as the seal of approval for markets both domestic and abroad.

Knowing the characteristics of the index underlying a fund, as well as the history, expertise and the integrity of the index provider are critical pieces of information that all investors should have upfront. In a time when financial market transparency is being called into question, it’s important that investors have at their fingertips the relevant information necessary to make an educated and informed investment decision.

The posts on this blog are opinions, not advice. Please read our Disclaimers.