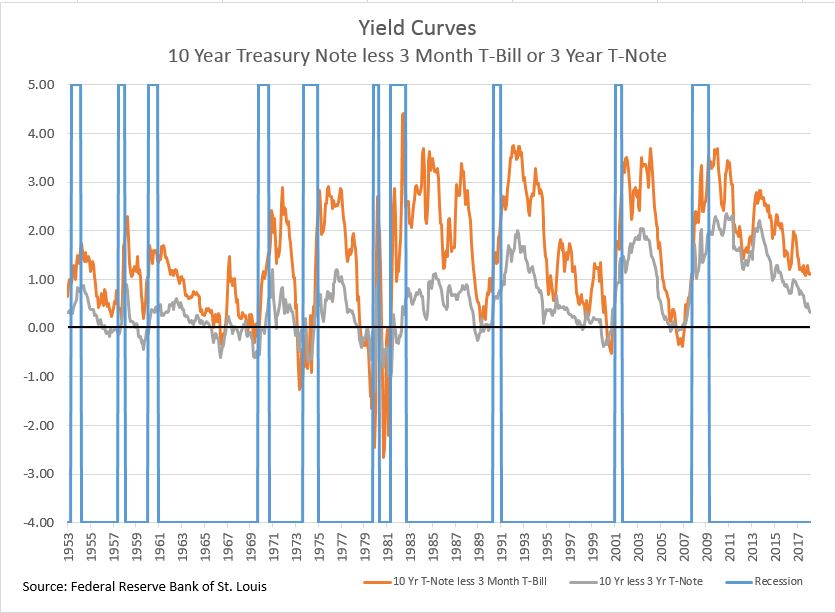

The slope of the yield curve is a good recession predictor. When the curve is inverted – when the yield on three month T-bills is greater than the yield on the ten year T-Note – a recession is imminent. Similar signals can be seen if the T-bill is replaced by a two- or three-year T-Note or the Fed funds rate. The same result is found if one uses 20- or 30-year treasuries instead of the ten-year, although there is less data available for the longer maturities. The chart shows the spreads based on the ten-year note and either three-month bills or three-year notes. The vertical bars mark recession.

Currently the Fed is pushing the Fed funds rate upward and it is dragging other short term interest rates higher while the yield on the ten year note remains a touch below 3%. The yield curve isn’t inverted yet, but is headed that way. Market expectations shown by trading in Fed funds futures point to two more increases in the Fed Funds rate this year, reaching a range of 2.25%-2.5% at year-end. In his testimony today, Fed Chairman Powell said that gradual rate increases will continue.

Market commentary is focused on the yield curve trying to resolve the conflict between today’s strong economy and the yield curve’s warning.

For economic and monetary policy, the level of the real or inflation adjusted Fed funds rate matters as well as the relative positions of short and long interest rates. Normally the real Fed funds rate is positive. Over the last seven decades, it averaged 1.27%. When the real Fed funds rate is below zero, as it has been recently, monetary policy provides unusually large accommodation and support to the economy. That is why the Fed pushed the real funds rate into negative territory after the financial crisis. It is also a factor in the currently strong labor. The second chart shows the yield curve based on the 10 year T-Note and 3 month T-bill and the real Fed funds rate.

Before almost every recession, as the yield curve inverted the real Fed funds rate climbed sharply higher. The exception was the short recession in 1980 followed by a failed recovery and a second recession within 12 months. As long as the real funds rate remains in negative territory, analysts can temper their anxiety over the yield curve. Today the real Fed funds rate is -1.0% while the Fed’s current range for the nominal rate is 1.75%-2%. The recent Monetary Policy Report from the Fed suggests that the nominal Fed funds rate range will top 3% in 2019, pushing the real rate into positive territory as long as the inflation goal holds. There will always be another recession. The next one may not be as soon as the yield curve hints.

The posts on this blog are opinions, not advice. Please read our Disclaimers.