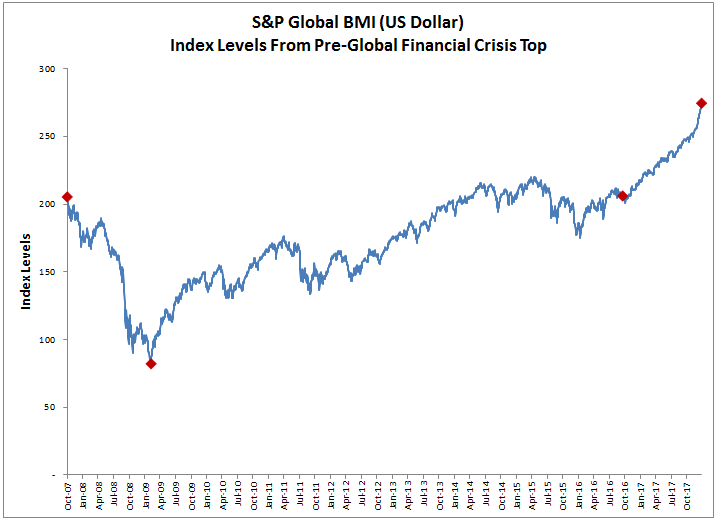

2017 was generally kind to U.S. shareholders of domestic and international equities, but long-term U.S. Treasury Inflation-Protected Securities (TIPS) rates drifted downward, increasing the present value of future inflation-adjusted cash flows discounted to the TIPS curve. An important question for retirement savers may be whether investment returns outpaced the increased cost of securing future in-retirement income.

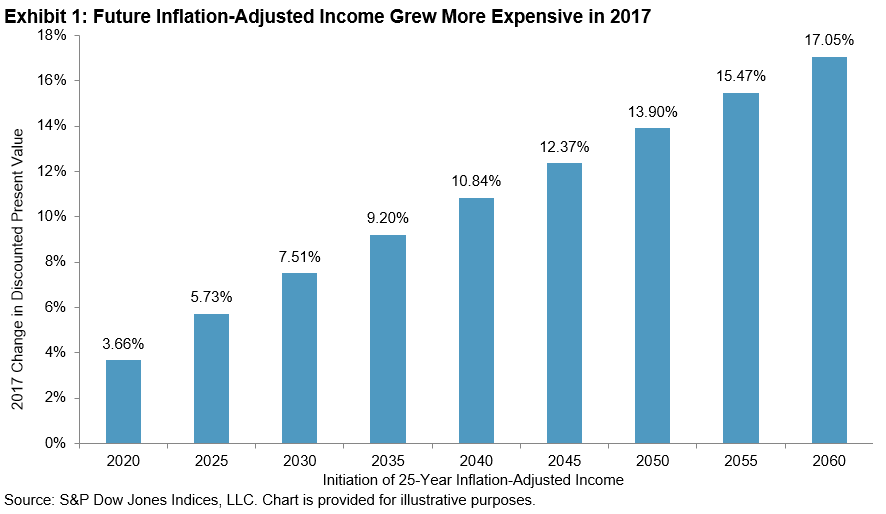

Exhibit 1 shows the change in present value in 2017 of 25-year inflation-adjusted cash flows, commencing in each of the respective years on the horizontal axis. Discount rates used to calculate pricing are derived from the TIPS yield curve. As expected, the chart illustrates that for a given change in rates, the longer duration cash flows experience more of a price change. Retirement savers planning to retire around 2030, for example, saw the cost of providing themselves 25 years of inflation-adjusted income increase by 7.5%. Other income sources, such as insurance company annuities, would generally move in the same direction but by varying magnitudes, depending on a number of external factors, like the insurance company profit margin and various features of specific annuity contracts. Nevertheless, tracking income cost by this straightforward method is a reasonable proxy for the cost of future income, and S&P DJI provides this metric monthly as part of its S&P STRIDE Index Series offering.

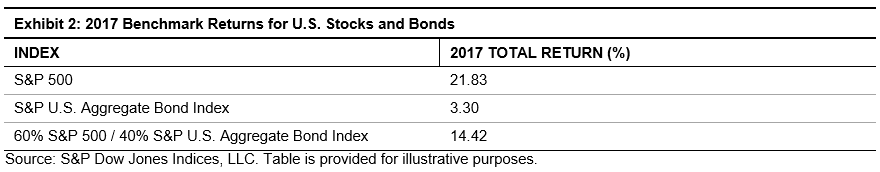

Exhibit 2 shows the 2017 total returns of U.S. stocks and bonds, as measured by the S&P 500®, the S&P U.S. Aggregate Bond Index, and a hypothetical 60/40 mix of the two.

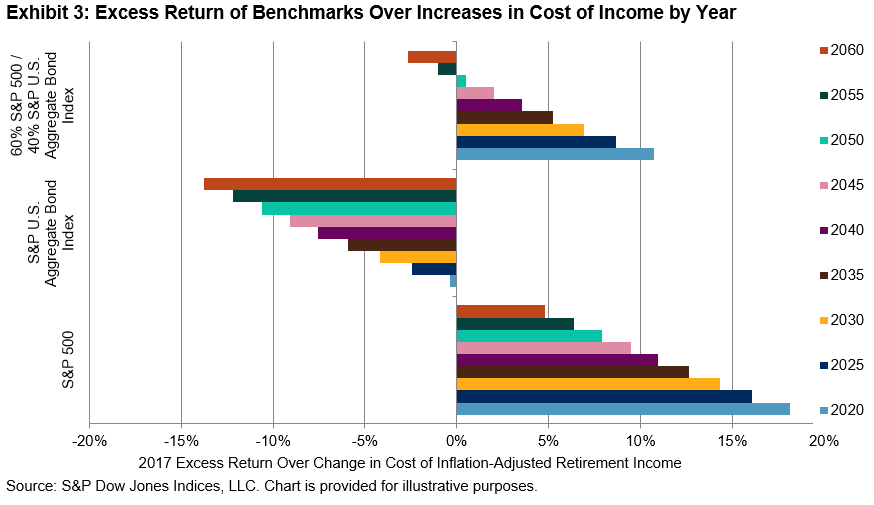

For each of the benchmarks in Exhibit 2, Exhibit 3 shows the excess total return of the respective benchmark over the increase of the cost of income for each respective year (from 2020 to 2060). A couple of observations stand out in Exhibit 3. For all of the target years from 2020 to 2060, U.S. equities outpaced the rise in cost of future income. Of course, the volatility of equities means that from year to year this will not always be the case, but 2017 was kind to shareholders.

On the other hand, the broad U.S. bond market, as measured by the S&P U.S. Aggregate Bond Index, while returning a respectable 3.3%, failed to keep pace with the rise in cost of future income for any respective target years. Those only a few years from retirement with a higher exposure to bonds, and particularly short-term bonds, would find that their portfolio did not keep pace with the cost of income.

Lastly, the 60/40 stock/bond mix held up fairly well for most of the target years, but particularly well for those cohorts approaching retirement first. The years 2020 to 2035 all saw excess returns from a 60/40 mix of at least 5%. However for 2055 and 2060, there was not enough equity risk in the 60/40 mix to keep pace with the significant rise in cost of income commencing in those respective years.

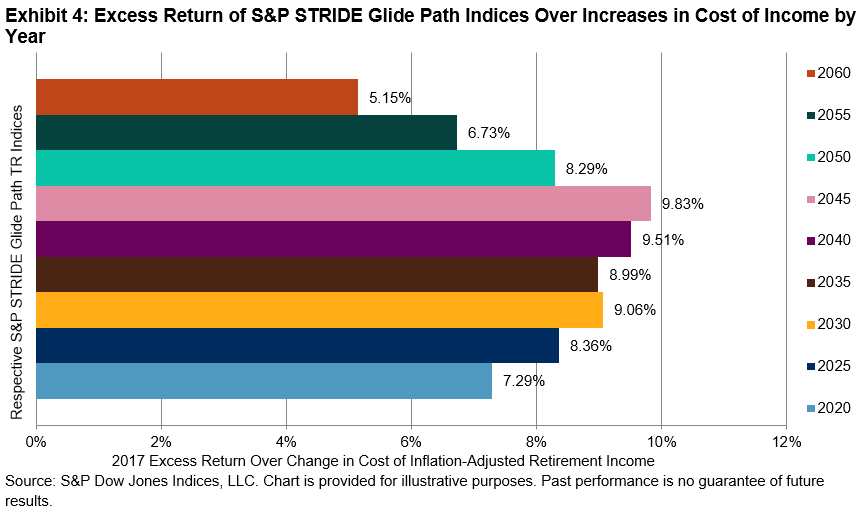

Finally, Exhibit 4 is similar to Exhibit 3, but it shows the excess total return of specific S&P STRIDE Indices over the rise in cost of future income.

Like the S&P 500, the S&P STRIDE Indices outpaced the rise in cost of future income for all target years from 2020 to 2060. However, unlike the S&P 500, excess returns for all target years (including 2060) were greater than 5%. In addition, the range of excess returns across target years was significantly tighter than it was for the S&P 500, the S&P U.S. Aggregate Bond Index, or a 60/40 mix of the two.

As a result of the S&P STRIDE Index Series methodology, the index weight of near-dated S&P STRIDE Indices are heavily allocated to a mix of U.S. TIPS matching the duration of retirement income for the respective target year. For example, as of December 2016, the weight allocated to U.S.TIPS in the S&P STRIDE Glide Path 2020 Index Total Return was 65.7%. In spite of having significant fixed income within the index, excess return over change in cost of income was substantially positive (unlike the comparison using the S&P U.S. Aggregate Bond Index). 2017 showed that the strategy underlying the S&P STRIDE Indices met its design objective of generally offsetting changes in the cost of future income. Retirement savers should take note that managing portfolios to mitigate future income risk may make the transition from work to retirement a lot smoother.

The posts on this blog are opinions, not advice. Please read our Disclaimers.