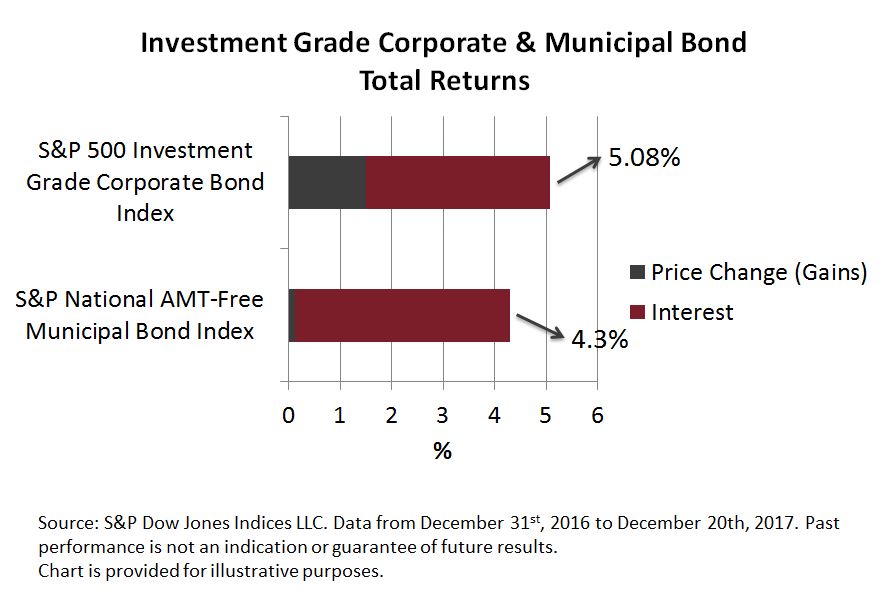

The 2017 low interest rate environment has created a wonderful example of the power of tax-exempt bonds. On a nominal return basis, investment grade corporate bonds tracked in the S&P 500 Investment Grade Corporate Bond Index have outperformed tax-exempt bonds tracked in the S&P National AMT-Free Municipal Bond Index. By considering the tax implications, using tax rate assumptions, the power of tax-exempt municipal bonds becomes evident. After all keeping more of the return is more important than the nominal return!

Chart 1 shows the returns broken down in price return (gains) and interest return. No attempt was made to address Original Issue Discount (OID) bonds which also have tax advantages regarding price appreciation.

Chart 1: Year-to-Date Returns of Select Investment Grade Bond Indices:

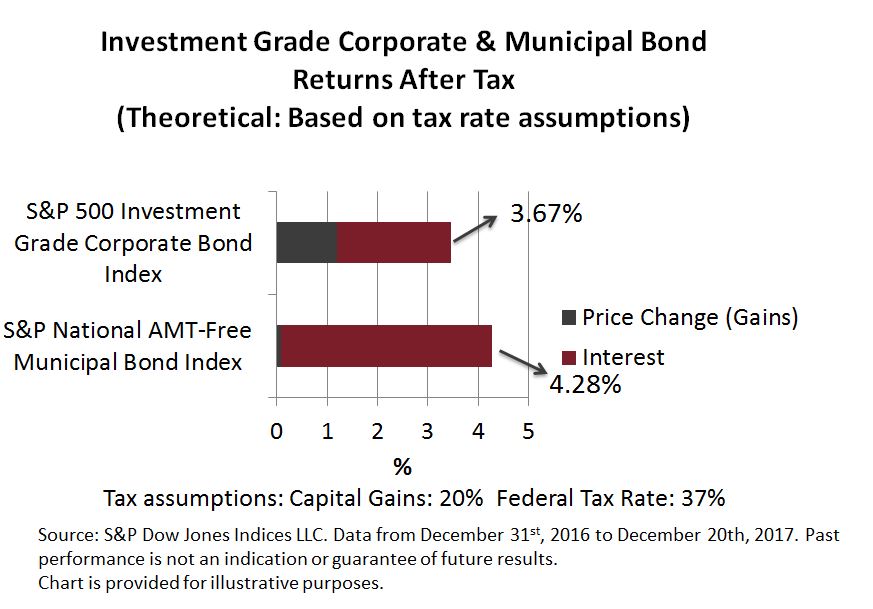

Viewing the returns of both asset classes, corporate and municipal bonds, from the perspective of returns after taxes reverses the trend. It is important to note that this analysis is just illustrative and is based on tax rate assumptions.

Chart 2: Year-to-Date Returns of Select Investment Grade Bond Indices After Federal Tax Rate Assumptions are Applied:

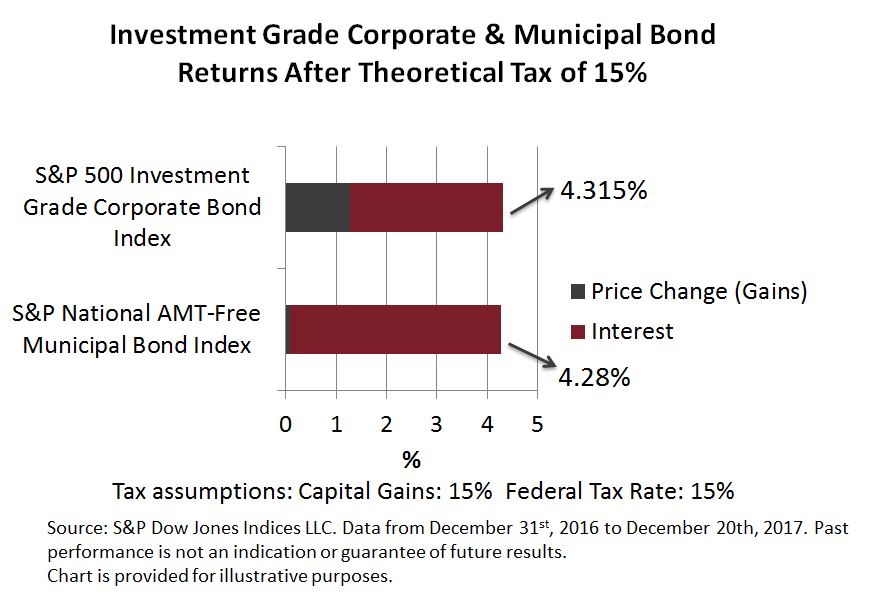

Taking the assumptions one step further, I looked to find what federal tax rate assumption on capital gains and interest income would be required for investment grade corporate bonds to return approximately the same return as tax-exempt municipal bonds from an after tax basis. Chart 3 illustrates the result: 15%. To me that means tax-exempt municipal bonds may have value for a wider investor base beyond the highest tax brackets.

Chart 3: Year-to-Date Returns of Select Investment Grade Bond Indices After Applying a 15% Federal Tax Rate Assumption: