In a previous post, “Rising Above the Noise in ESG: Green Bonds,” we argued that green bonds provide a simple way to add an element of environmental investing into core fixed income holdings. In this blog, we take a closer look at the composition of the S&P Green Bond Select Index and show that it can also help diversify exposure away from global treasuries and add much-needed exposure to infrastructure bonds.

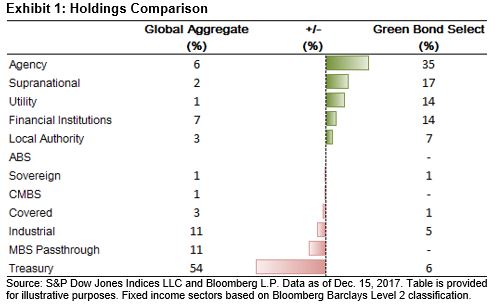

The S&P Green Bond Select Index can help diversify core fixed income exposure away from treasuries. With the exception of mortgage pass-through securities, the green bond market has diversified to include bonds from the major core segments of the global fixed income universe. Despite the diversity of bond types in the green market, the mix of assets is different than the Bloomberg Barclays Global Aggregate Bond Index. Aside from the difference in mortgages, the biggest difference between the two is in the treasury component. As of Dec. 15, 2017, there were just two central government bonds issued in the green market, and they both qualified for the S&P Green Bond Select Index—a local government bond (treasury) issued by France, which accounted for about 6.2% of the investable index, and a sovereign bond issued by Poland in Euros. In contrast, the treasury and sovereign components of the Bloomberg Barclays Global Aggregate Bond Index totaled 55% (see Exhibit 1). Some market participants have been looking for a way to diversify away from treasuries, and green bonds may be one opportunity to do this.

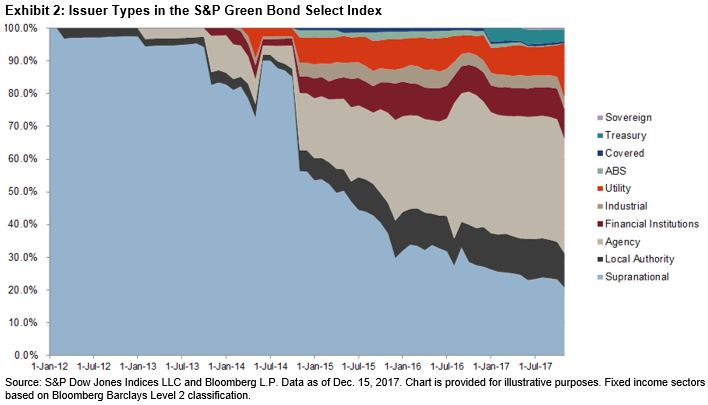

Agencies, supras, and local authorities account for the lion’s share of the S&P Green Bond Select Index, representing 60% of the index as of Dec. 15, 2017, down from 70% in December 2015 and 90% in December 2013 (see Exhibit 2). Corporates, utilities, and commercial banks have accounted for at least one-half of the gross supply over the past two years.

Aside from differences in composition, there is a fundamental distinction in the nature of the assets that market participants should take note of. By nature, green bonds are issued to provide financing to help with the transition to a low-carbon economy. The use of proceeds can range from financing consumer auto loans and leases for electric cars to large national infrastructure projects.

One recent example of a large-scale infrastructure investment opportunity is the bonds issued by the Mexico City Airport. The new international airport is one of the largest public infrastructure works in a century. Total funding required is about USD 13.3 billion, with 60% coming from the federal government. In September 2017, the airport trust issued USD 4 billion in green bonds, adding to the USD 2 billion issued in 2016. Broadly across emerging markets, there is an extensive demand for financing infrastructure, and with the evolving need to build it with an eye on sustainability and carbon efficiency, one might expect a shift in issuance to the green market.

Despite the differences highlighted, the two indices are relatively similar in terms of characteristics. As of Dec. 15, 2017, the two indices were relatively similar with respect to credit quality, duration, and yields. We highlight again that since the launch of the S&P Green Bond Select Index on Feb. 17, 2017, its performance has been highly correlated to the Bloomberg Barclays Global Aggregate Bond Index. In fact, over the same period, the S&P Green Bond Select Index has outperformed, returning 3.5% more than the Bloomberg Barclays Global Aggregate Bond Index.

For a further look at this topic, watch A Look Inside the S&P Global Green Bond Index.

If you enjoyed this content, join us for our Seminar Discover the ESG Advantage in

London on May 17, 2018.