The S&P GSCI Crude Oil Total Return is up 15.2%, its biggest six day gain, ending Aug. 18, 2016, since the six day gain of 16.1%, ending on Apr. 13, 2016. As both the IMF (International Monetary Fund) and IEA (International Energy Agency) consider the oil price as a major input to global GDP estimates, and the IMF states the oil price assumptions used for the current World Economic Oulook Update (WEO) are about $10 higher for 2016 and 2017 than those used for the April 2016 WEO, one may consider evaluating the impact of an oil price increase on equity sectors since equities are the biggest holding for many investors.

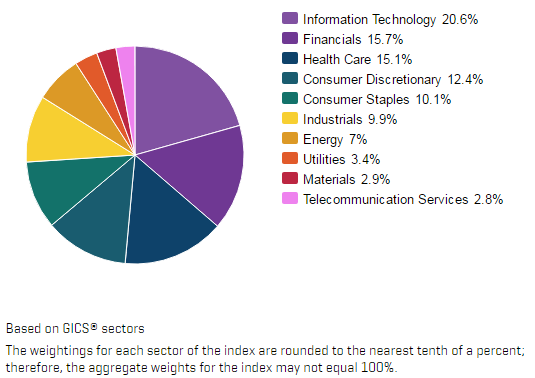

Using monthly index data from Dec. 1998 for S&P 500 Sectors and oil, and also data from Aug. 2006 for S&P 500 Bond Sectors, some conclusions can be drawn about the sector sensitivity to oil and sentiment in sectors.

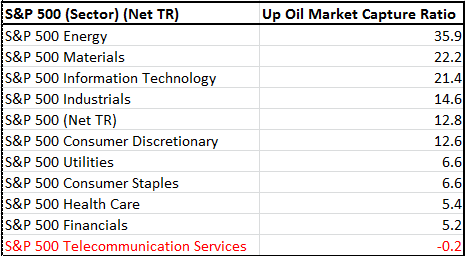

Interestingly, but perhaps not surprisingly, when oil rises, it helps all equity sectors except Telecom. In the table below, for every 1% increase in oil, the telecom sector loses 2 tenths basis points. It’s not much but it is the only losing sector.

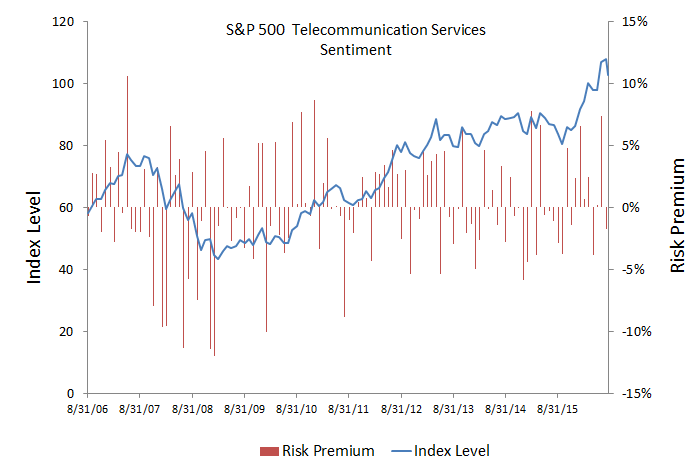

Telecom may suffer with rising oil prices since gasoline and automobile demand may decrease that slows integration of connectivity in cars. It also may slow growth in digital technologies that make it easier to access and pay for public services using mobile devices, such as parking and transportation. Also, investors are feeling most pessimistic about telecom since Dec. 2014, based on the excess return of bonds over stocks in the sector. Back then, the index lost 10.8% through Sep. 2015, so it is possible this could indicate another drop.

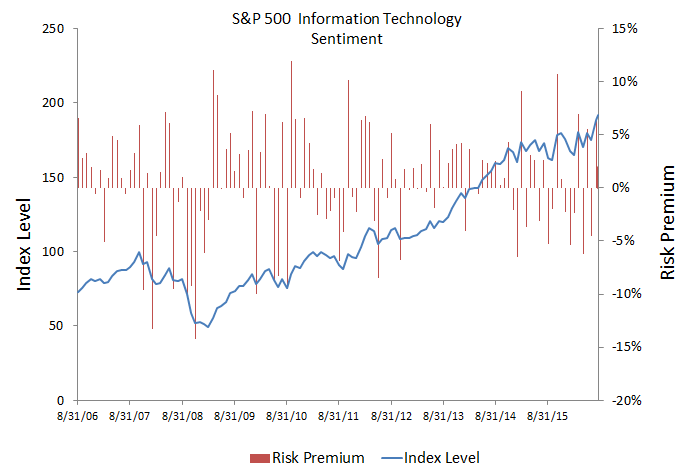

Putting aside energy and materials that clearly rise from an oil increase, technology gains most from an oil increase, rising on average nearly 22 basis points for every 1% gain in oil. Energy companies have increased efficiency tremendously over the past few years by investing in new technology, so as oil rises, it makes sense that energy boosts the tech sector. However, while investors are still willing to take some risk in the upside of the tech sector right now, the pessimism in tech (rapidly declining risk premium) has peaked this month the most of any sector, reflecting a shift away from the sector, despite the oil gain, and that is a warning signal.

One must consider the fear in tech for the broader implications on the stock market, given technology is the digital backbone of the economy and the mood is getting gloomy. This is since tech is one of the most highly correlated (0.83) sectors to the S&P 500 and the S&P 500 captures much (52%) of tech’s losses.

The falling dollar may help oil further if the fed doesn’t raise rates. It gains about 4.3% for every 1% US dollar drop that should translate into almost at 1% gain for tech. However in the past week the dollar fell near 1.5% but tech has only gained about 25 basis points in this oil rally of more than 15%, which reflects potential economic weakness.

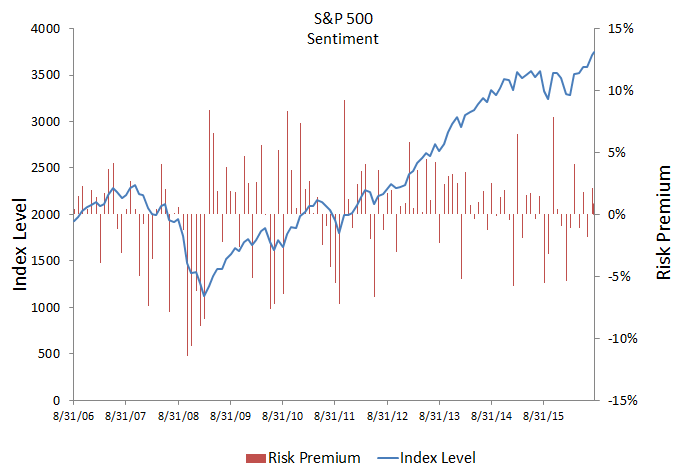

More than a 5% discount in S&P 500 bond over stock performance and some persistence historically indicates a true downturn in the overall stock market. There have only been 3 consecutive discounts one time since 2011 and that was in Q1 2016. Now there is still a slight premium but it is dropping quickly, so it doesn’t feel like a crisis but it’s jittery.

Our 10th Annual Commodities Seminar takes place in London on 29th September. Additional information and registration are available online now. #SPDJICommods

The posts on this blog are opinions, not advice. Please read our Disclaimers.