Global equity markets stumbled out of the gate in 2016, and still haven’t found their stride. Markets are experiencing an intense case of risk off sentiment, as investors flee from riskier assets in pursuit of safe havens. The yield of 10 year US Treasury Notes is down to less than 1.8%, while oft-maligned gold is coming back into favor. The VIX is also up above 26, which is over 50% higher than it was at the same time last year.

The S&P 500 remains in correction mode, as safety seems to be the name of the game. The Utilities Sector of the S&P 500 has surged in 2016, following a weak 2015. Through Friday’s close, the Utilities sector was up 8% on the year, while the broader S&P 500 was down 8% (both on a total return basis). The Consumer Discretionary sector was the strongest sectoral performer in 2015. Thus far in 2016, it had been one of the weakest, declining 12%.

This is driven in no small part by fears of slowdown in global growth, specifically in China. According to the Wall Street Journal, data out of China over the weekend showed that China’s foreign exchange reserves fell nearly 100 billion USD last month as Beijing defends the value of the Yuan in the face of growing short interests and following a 108 Billion USD decline in December. Granted, China still has over 3 trillion USD in foreign exchange reserves to work with, so this may not be as bad as it seems. Following the unexpected devaluation of the Yuan in August of last year, however, market participants are undoubtedly a little on edge.

It comes as no surprise that low volatility strategies have outperformed in this environment. The S&P 500 Low Volatility High Dividend Index was up nearly 1% through close Friday. Typically these strategies outperform in choppy markets as they decrease downside exposure. In other words, low volatility strategies provide some protection when volatility rides again.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

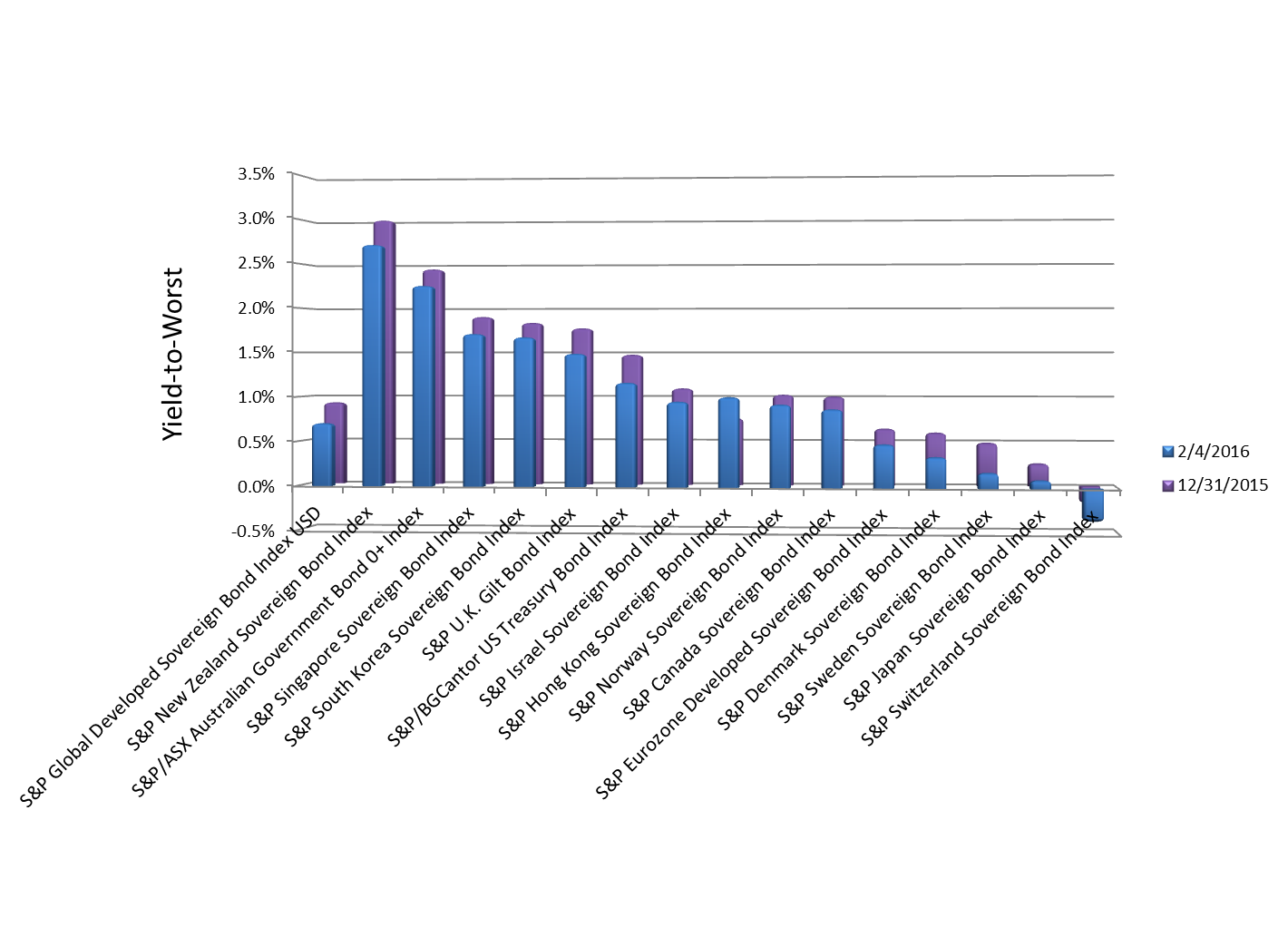

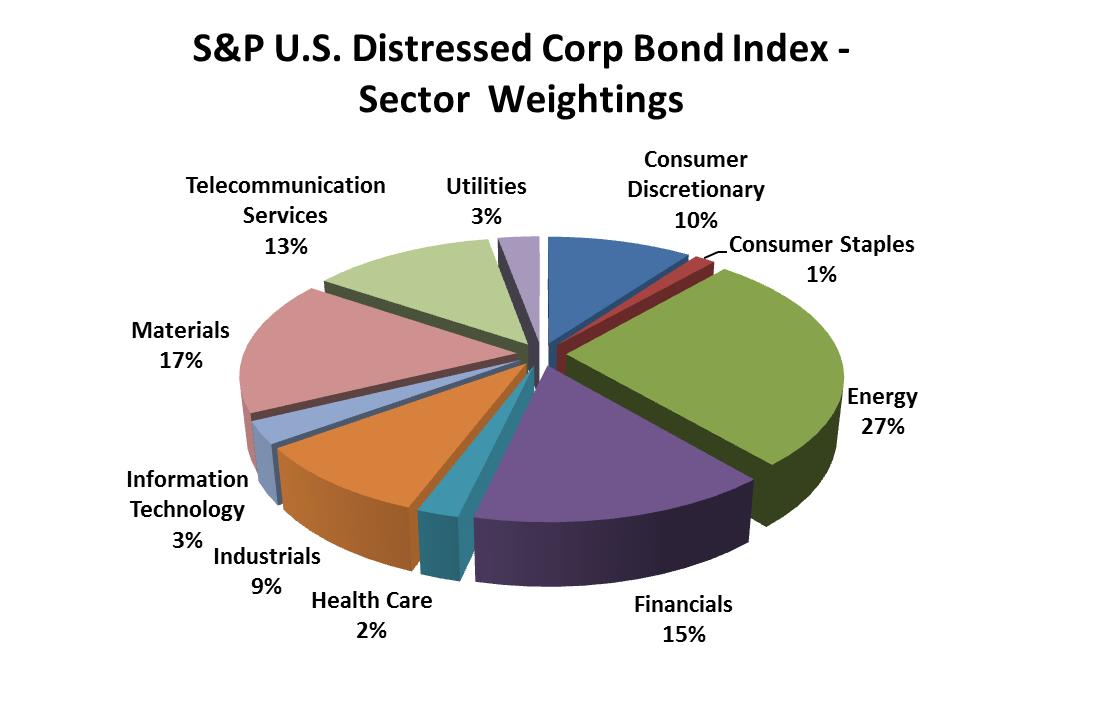

Source: S&P Dow Jones Indices LLC. Data from February 2016. Chart is provided for illustrative purposes.

Source: S&P Dow Jones Indices LLC. Data from February 2016. Chart is provided for illustrative purposes.