Uncertainty is a four letter word in bond markets and can lead to significant volatility. The Greek debt dilemma is becoming more and more dire each day. European government bond markets are reacting with some significant swings. Germany and the IMF offered Greece a deal last week that would require strict adherence to austerity reforms, only to be harshly criticized by Greek PM Tsipras on Tuesday. Last Wednesday, Standard & Poor’s Ratings Agency cut Greece’s credit rating one notch to CCC, and indicated a default could happen in the next year if they cannot come to an agreement with their creditors.

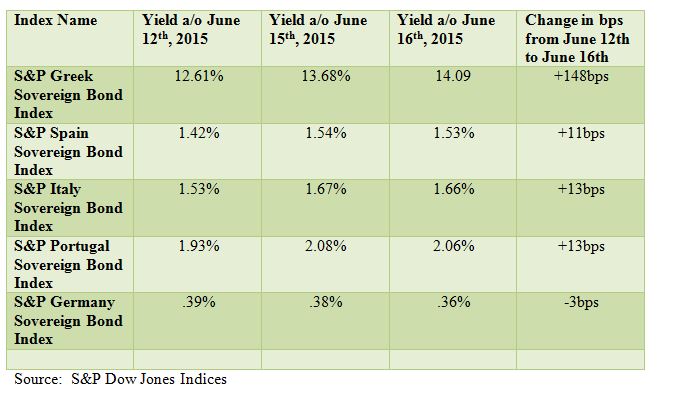

The European government bond markets are reacting to the possibility that an agreement may not be made and are choosing to play it safe. The riskier countries like Spain, Italy and Portugal took a hit on Monday. While the impact of a Greek exit from the Eurozone may be less than it would have been back in 2012, the fear of contagion is still very real. The S&P Spain Sovereign Bond Index yield saw an 11 bps move upward from last week’s close, the S&P Portugal Sovereign Bond Index yield rose 13 bps, and the S&P Italy Sovereign Bond Index yield increased by 13bps. In contrary, the S&P Germany Sovereign Bond Index tightened 3bps during this time period, along with the flight to safety. (See table below.)

Greek sovereign debt took the biggest hit and the S&P Greek Sovereign Bond Index widened 148 bps as of Tuesday’s close. While June 30th is a deadline for Greece’s ultimate fate, European finance ministers are meeting this Thursday to try to resolve the crisis. For now, the only thing that remains constant in this crisis is that four letter word.