Catastrophic weather events are happening now as we are experiencing deadly heat in India, floods in Houston, Oklahoma and Mexico, and the drought in California. The ENSO (El Niño Southern Oscillation): Recent Evolution, Current Status and Predictions report prepared by the Climate Prediction Center / NCEP of NOAA (National Oceanic and Atmospheric Administration) stated on May 26, 2015 that El Niño conditions are present and there is an approximately 90% chance that El Niño conditions will continue through Northern Hemisphere summer 2015, and a greater than 80% chance it will last through 2015.

In some cases as in California where the El Niño may bring much wanted rain, the elevated ocean temperatures are welcome. However, the consistency in temperature increases hasn’t been enough to shift growing seasons, so is more destructive to crops in general than helpful and may disrupt the global food market.

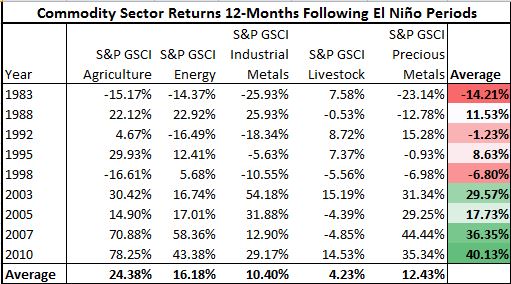

In a post last year, spikes in agriculture following El Niño periods were shown to be significant. Now the study has been expanded to measure all of the five sectors 12 months performance post the El Niño periods. The result is that the global food market is not the only market that may get disrupted. Notice on average that all sectors have positive returns in the 12 months following the El Niño periods.

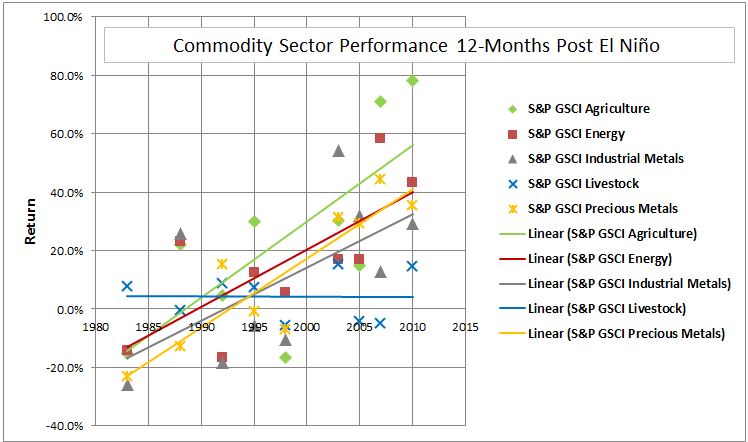

What is most interesting is commodity sector returns have increased through time in each of the 12 months following the temperature rise since the El Niño of 1982-1983. This is true for every sector except livestock. On average the annual increase using El Niño periods for agriculture is 2.6%, energy 2.0%, industrial metals 1.8% and precious metals 2.4%.

This El Niño may be just another potential boost with a little more octane than in history that can act as a catalyst for commodities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.