Chinese bonds continue to attract attention from global investors as they offer relatively higher yields, what’s more, Chinese bonds also have historically demonstrated low correlations with global markets.

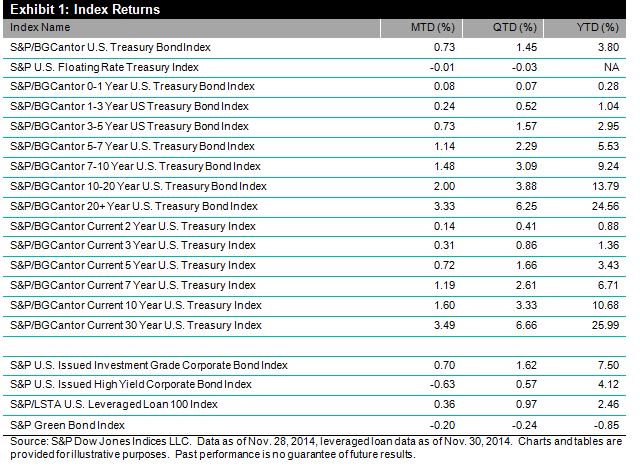

Exhibit 1 shows the correlation of the S&P China Sovereign Bond Index with major sovereign bond indices in global markets. While the index has a low correlation of 0.09 with the developed sovereign bonds, it exhibits a negative correlation of 0.12 with the Eurozone developed sovereign bonds.

Thus, Chinese bonds do not only provide the portfolio diversification through the exposure to local rate, credit and currency, they would also be a good hedge to the global fixed income portfolio. And of course, not to mention, China has a higher credit rating than most countries.

The S&P China Sovereign Bond Index currently tracks CNY 9.3 trillion of sovereign bonds. As of Dec 4, 2014, the index has delivered a YTD return of 9.48%. The index’s yield-to-worst is at 3.54% with the modified duration of 5.55.

Exhibit 1: Correlation Chart

Please click here for more information on the S&P China Sovereign Bond Index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.