The People’s Bank of China (PBoC) announced rate cuts on Nov 21; with 1-year deposit rate lowered by 25bps to 2.75% and the lending rate lowered by 40bps to 5.60%. The market is expecting the rate cut not only to revive the growth but also accelerate the interest rate liberalization. The cash bonds responded favorably as the yield curves tightened.

The S&P China Composite Select Bond Index is an investible, liquid and transparent index that covers Chinese sovereigns, policy banks and Central State-Owned Enterprises (CSOEs). According to the index, the yield-to-worst has tightened by 12bps in a week and 22bps in November.*

Comparing across the sectors, the Chinese government bonds outperformed the corporate bonds last month; the S&P China Government Bond Index advanced 1.56%.

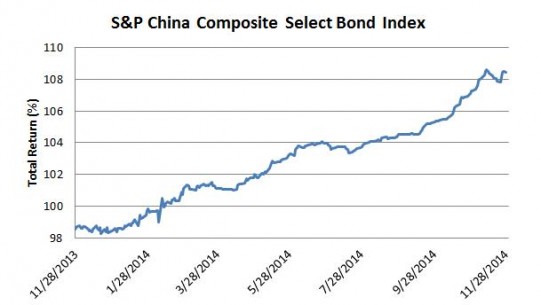

Looking at the 2014 year-to-date performance, the S&P China Composite Select Bond Index has delivered a total return of 10.03%.* The index’s yield-to-worst has tightened by 170bps to 3.96%, while touching the YTD low at 3.85% on Nov 12. Nevertheless, Chinese bonds continue to gain traction among global investors as they offer higher yields than the bonds from other major markets.

Exhibit 1: The Total Return of the S&P China Composite Select Bond Index

*All data are as of Nov 28, 2014.

Please click here for more information on the S&P China Composite Select Bond Index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.