Fed a Small Step Closer to Raising rates

Today’s FOMC statement published after the meeting is more upbeat than the last one in discussing the labor markets and the inflation outlook. The FOMC noted “solid gains and a lower unemployment rate” and that the “likelihood of inflation running persistently below 2 percent has diminished somewhat” despite lower oil prices. In announcing the end of QE, the statement noted “substantial improvements in the outlook for the labor market since” QE began.

The balance in the FOMC may be shifting at the same time. There was one dissent from Narayana Kocherlakota of the Minneapolis Fed arguing for a more dovish position than the Committee took. At the previous meeting in mid-September there were two dissents arguing for a more hawkish position and quicker action for higher interest rates.

The full minutes of the previous FOMC meeting included a discussion of Fed operating procedures and how they would raise interest rates in the face of some $3 trillion-plus of excess reserves. The summary statement from that meeting mentioned concerns about removing policy accommodation. This time the lack of any mention of operating procedures suggests that the FOMC is confident that it can raise interest rates when the time is right.

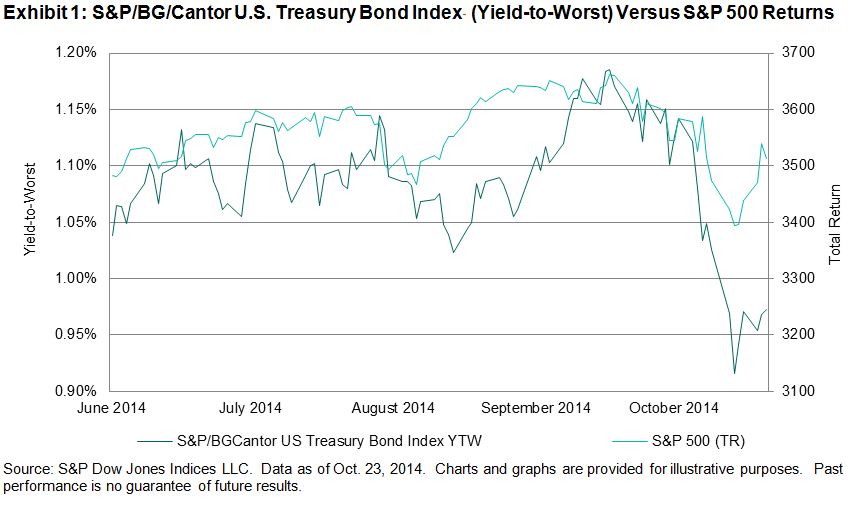

None of this points to a precipitous move to boost interest rates quickly. However, the Fed recognizes – and the apparently the FOMC acknowledges to itself – that the policy target on unemployment is close at hand and the trend in core inflation is shifting towards 2%. Markets and investors will begin to react. Forecasts of when the Fed might move and what the Fed Funds rate might be at the end of 2015 will be revised to the hawkish side.

The CME Group FedWatch, based on trading in 30 days Fed Funds Futures Contracts, reveals that the probability of a rate hike by next June is above 50-50. The chart below was captured at 3:50 PM Eastern on October 29th. See the Fed Funds Probability tool here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.