Similar to active managers, who attempt to identify stocks with above-average performance, investors who use active funds aim to identify managers who will outperform their peers. Our SPIVA® Scorecards consistently show that most active managers underperform most of the time. But not all funds, and not all the time. How might such outperforming funds be identified in advance?

Notwithstanding the commonly used disclaimer that “past performance is no guarantee of future results,” one obvious place to search is among those funds that outperformed in the past. However, the reliability, if any, of history as a guide to manager selection is critical: examining the persistence of active success helps us disentangle managers with true skill, from those simply visited by good fortune.

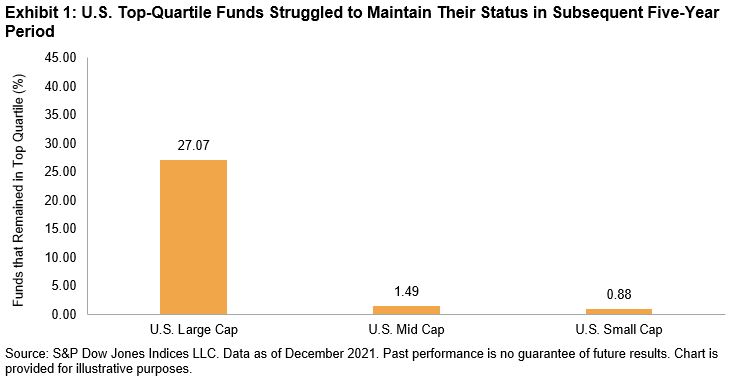

Our Persistence Scorecards measure the degree to which historical relative performance predicts future relative performance. One measure included in the report is the proportion of funds that were top quartile (versus their peers) that remained so over various time periods. Sourced from our U.S. Persistence Scorecard Year-End 2021, Exhibit 1 shows that only 27% of top-quartile U.S. large-cap funds from December 2011-December 2016 remained in the top quartile for the next five years, slightly above the 25% rate we’d see if performance were completely random. Meanwhile, U.S. mid- and small-cap funds performed even worse. A miniscule 1% of top-quartile U.S. mid- and small-cap funds remained in the top quartile during a subsequent five-year period, refuting a common assertion that it is easier to sustain outperformance within the smaller-cap space.

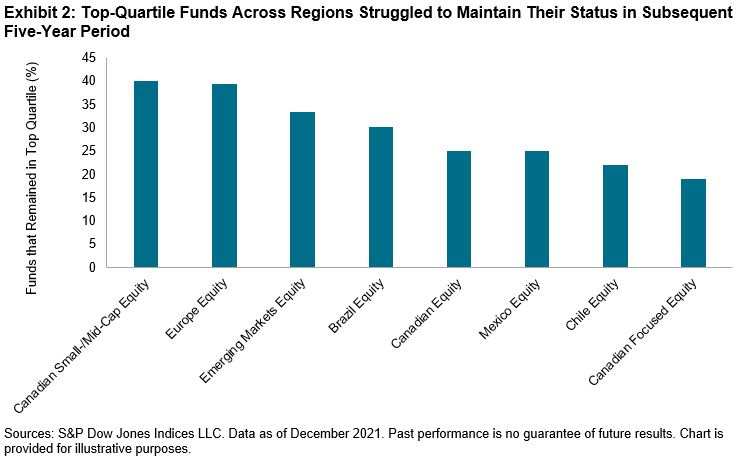

More importantly, these performance persistence problems are not unique to the U.S, with similar results across Canadian, European, Latin American and global emerging markets,1 as illustrated in Exhibit 2.

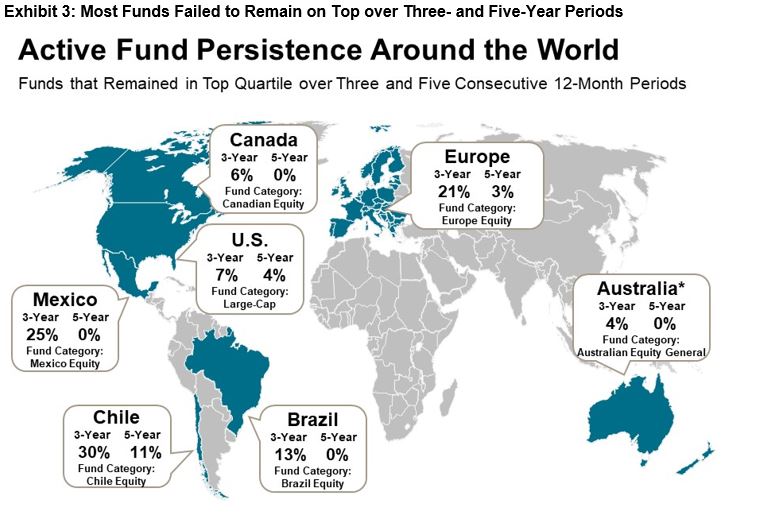

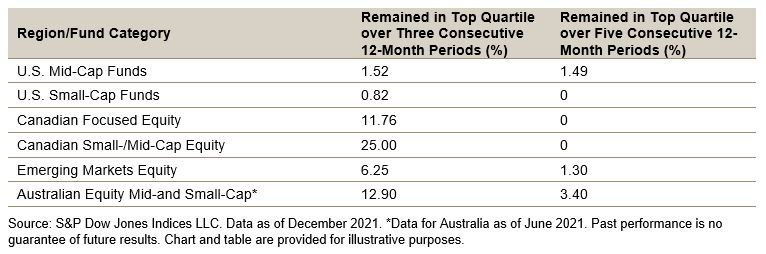

Extending our time horizon, Exhibit 3 shows there is an exponential decrease in persistence over longer time periods. For example, while 25% of Canadian Small-/Mid-Cap Equity funds maintained their top status over three consecutive years, that number dropped drastically to zero over a five-year period. Funds across regions fared no better, with none of the U.S. Small-Cap, Canadian, Brazil or Mexico Equity funds able to stay in the top quartile over five consecutive years, indicating that when outperformance does in fact occur, it tends to be fleeting.

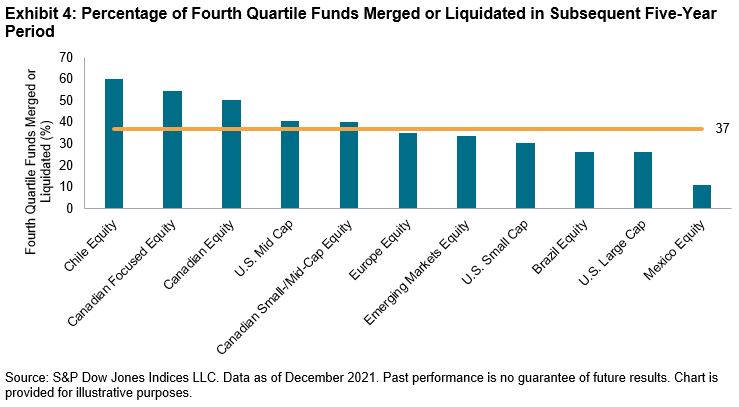

Unsurprisingly, the worst-performing funds across regions are likely to end up merging or liquidating. We see in Exhibit 4 that on average almost 40% of fourth-quartile funds globally disappeared over a subsequent five-year period.

The lack of persistence among active managers globally is not a new phenomenon. These results suggest that short-term success, when it occurs, may arise as much from luck as from genuine stock selection skill.

1 Benchmark is the S&P/IFCI Composite for Euro-denominated Emerging Markets Equity funds.

The posts on this blog are opinions, not advice. Please read our Disclaimers.