Since their launch in April 2021, the S&P Quality, Value, and Momentum Top 90% Multi-factor Indices (the “S&P QVM Top 90% Indices”) have been a great addition to our multi-factor lineup. These indices are designed to track companies in the top 90% of their respective underlying index universe, ranked by their multi-factor score.

To support this index series, we plan to publish quarterly blogs providing transparency into rebalance adds and drops. Exhibits 1, 2 and 3 summarize the March 2022 rebalance adds and drops for these indices, as well as the decile rank of their individual quality, value and momentum scores.

The 1st decile includes companies ranked in the top 10% of the universe (by their respective factor score), the 2nd decile includes companies ranked in the next highest 10%, and so on through to the 10th decile.

S&P 500® QVM Top 90% Index Rebalance Adds/Drops:

Since the December 2021 rebalance, Gap Inc. has been removed from the index as it moved to the S&P MidCap 400®, and IHS Markit has been removed since it merged with our parent company, S&P Global. This explains why there were 13 drops and 15 adds in the March 2022 rebalance.

Risk-adjusted return played a major role in the drops, with 61% in the 10th decile based on momentum score. Based on quality score, 30% of the drops were in the 10th decile, and based on value score, 38% were in the 10th decile.

Based on the overall multi-factor score rank, 40% of the adds ranked in the top half of the universe, mostly driven by quality and momentum.

S&P MidCap 400 QVM Top 90% Index Rebalance Adds/Drops:

Seven companies had been removed either due to corporate action related events or due to movements across the cap range since the December 2021 rebalance. Therefore, there were seven more adds than drops in the March 2022 rebalance.

Company fundamentals had a significant impact on the drops, as 75% were in the 10th decile based on value score. Based on momentum score, 50% of drops were in the 10th decile, and 25% were in the 10th decile based on quality score.

From reviewing the adds, 60% of companies had at least two factors ranked in the top half of the universe, and two-thirds were in the top half based on quality score rank.

S&P SmallCap 600® QVM Top 90% Index Rebalance Adds/Drops:

There were nine more adds than drops in the March 2022 rebalance, since nine companies had been removed either due to corporate action related events or movements across the cap range.

In terms of the drops, most of the companies ranked quite poorly across all three factors. Based on quality score, 44% of drops were in the 10th decile, 33% were in the 10th decile based on value score, and 33% were in the 10th decile based on momentum score.

With respect to the adds, about half were ranked in the top half of the universe based on momentum score.

Sector Weights

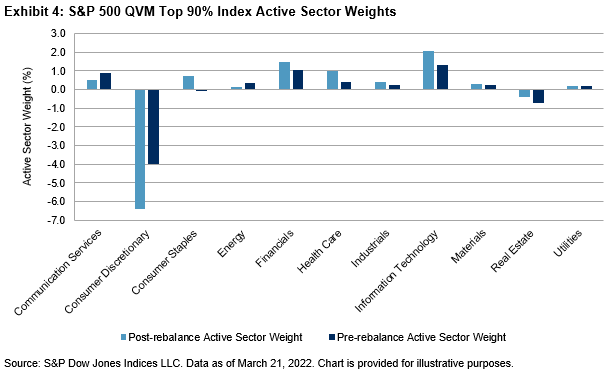

Due to the index construction methodology, significant deviations from the benchmark sector weight are uncommon. Exhibits 4, 5 and 6 show the pre- and post-rebalance active sector weights for each of the three S&P QVM Top 90% Indices.

Exhibit 4 shows that the relatively large underweight in the Consumer Discretionary sector has increased, as have the overweights in IT, Financials and Health Care.

For the S&P MidCap 400 universe, the largest underweights are in Health Care and IT, which increased and decreased, respectively. The largest overweights are in Financials and Consumer Discretionary.

For the S&P SmallCap 600 QVM Top 90% Index, Health Care has the largest underweight, at -1.35%, and Financials has the largest overweight, at 1.46%.