2021 started on a hopeful note, with COVID-19 vaccines coming to save the world. However, as in many other parts of the world, Latin American countries struggled to control the pandemic’s impact on their economies and societies. Additionally, political uncertainty and civil unrest in several countries contributed to a disappointing year.

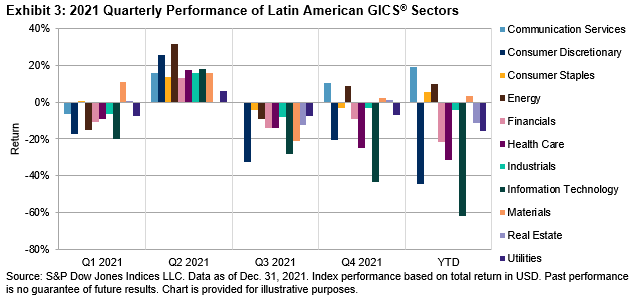

While most global markets experienced strong performance in 2021, the S&P Latin America BMI finished the year down 12%, with negative returns in three out of four quarters. It is interesting to note, however, that Latin America excluding Brazil had a different outcome, as the S&P MILA Pacific Alliance Composite gained 6.7% for the year (see Exhibit 1).

While headline indices from Argentina, Chile, Colombia, and Peru all closed 2021 in positive territory in local currencies, Mexico was the standout performer among Latin American countries as the S&P/BMV IRT gained 24.4% YTD (see Exhibit 2). The story was different in U.S. dollar terms, as all markets except for Argentina and Mexico ended in the red due to local currency depreciation against the U.S. dollar.

Brazil was the worst performer in 2021 in both Brazilian reals and U.S. dollars. Most Brazilian sectors underperformed; Financials, represented by the S&P Brazil BMI Financials Index (-24.3%), had significant losses and the greatest impact on the entire market. Mexico, on the other hand, had the largest annual gain since 2009, as shown by the S&P/BMV IRT. Most of this was driven by the double-digit gains of some of the largest Mexican companies like America Movil, Cemex, and Walmart de Mexico.

In terms of regional sectors, nearly all of them struggled to stay afloat (see Exhibit 3). In the end, for 2021, Communication Services (19.2% YTD), Consumer Staples (5.7% YTD), Energy (10.0% YTD), and Materials (3.1% YTD) were the only ones that accomplished that goal. The pandemic drove most people indoors to work, play, and shop. In Communication Services, companies like America Movil, Grupo Televisa, and Telefonica Brasil greatly benefited from increased subscribers to their online and pay TV services. Energy was driven up by solid annual price performances from Petrobras and Ecopetrol, which represented nearly 77% of the Energy sector. Consumer Staples, typically a reliable defensive sector, did not disappoint. Finally, Materials companies, which include producers of building materials, benefited from high demand for their products. Likewise, mining companies, particularly copper exporters, gained from historically high prices for their exports in 2021.1 On the downside, Financials, the largest sector in the region, was down 21.6% for the year. Brazilian financial institutions, representing 64% of the sector, had the most losses for the year, greatly contributing to the region’s disappointing returns.

As the COVID-19 pandemic continues to evolve, uncertainty envelops the region at the start of 2022. High inflation, weakness in local labor markets, expectations for rising interest rates, and political instability in several Latin American countries continue to weigh on equity market sentiment. All this points to what could be a significant shift in economic and governmental policies in 2022. For better or for worse, it promises to be another fascinating year.

For more information on how Latin American benchmarks performed in Q4 2021, read our latest Latin America Scorecard.

1 Source: S&P Global Ratings and CapitalIQ. Copper (Comex HG).

The posts on this blog are opinions, not advice. Please read our Disclaimers.