Global equities gained in the last quarter of the year, climbing 5.8% as measured by the S&P Global BMI. Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, outperformed their conventional counterparts by approximately 2.5% in the quarter due largely to their overweight in the U.S. Information Technology sector, which gained nearly 14% during Q4. Global Islamic indices finished the year with a near 2% advantage, while the performance differential varied across regions, as Asia Pacific developed and emerging markets underperformed their conventional benchmarks.

Drivers of 2021 Shariah Index Performance

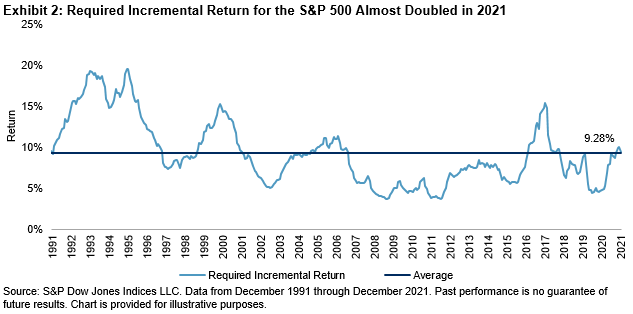

While global equities enjoyed broad gains throughout 2021, the greatest contributors of Shariah index performance were at the sector and country level (see Exhibits 2 and 3).

Energy—which enjoyed a substantial rebound in 2021 after poor performance in 2020—was the best-performing sector. Due to its low weight in indices, however, performance impact was muted. Meanwhile, Information Technology—which tends to hold an overweight position in global Islamic indices—gained nearly 30%, contributing one-half of annual gains.

On a regional basis, high average weight toward the U.S. favored the S&P Global BMI Shariah during 2021, as the country enjoyed the best regional performance. The underperformance of the Asia Pacific developed and emerging markets regions limited overall gains, as Shariah-compliant stocks in Japan, South Korea, and China suffered during the period.

MENA Equities Continued to Gain in 2021

MENA regional equities gained considerably in 2021, as the S&P Pan Arab Composite advanced 32.7%. All MENA country indices finished the year in positive territory, led by the S&P United Arab Emirates BMI, which gained an impressive 50.8%, followed by the S&P Saudi Arabia BMI, up 34.8%. The S&P Egypt BMI led performance during Q4, rallying 16.3% and sending the country index into positive territory at year end.

For more information on how Shariah-compliant benchmarks performed in Q4 2021, read our latest Shariah Scorecard.

This article was first published in IFN Volume 19 Issue 02 dated the 12th January 2022.

The posts on this blog are opinions, not advice. Please read our Disclaimers.