How are indices helping bring greater transparency to this emerging asset class? S&P DJI’s Tyler Carter and Ved Malla explore the design and objectives of new tools for tracking and evaluating digital currencies.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Demystifying Digital Assets: Getting to Know the S&P Cryptocurrency Indices

Stalwarts Continue to Increase Presence in the S&P 500 Low Volatility Index

Digital Asset Infrastructure – Custody

Exploring the Potential Implications of Market Reversals

The S&P Dividend Growers Indices: Examination of Risk, Return and Down-Market Performance

Demystifying Digital Assets: Getting to Know the S&P Cryptocurrency Indices

Stalwarts Continue to Increase Presence in the S&P 500 Low Volatility Index

If the equity market’s report card so far in 2021 is any indication, it’s on track to be another stellar year. Through Aug. 19, 2021, the S&P 500® is up 17%. The gains were achieved steadily; apart from January, the benchmark has been up every month in 2021. Predictably, in such an environment the S&P 500 Low Volatility Index has lagged, up 14% through close of Aug. 19, 2021.

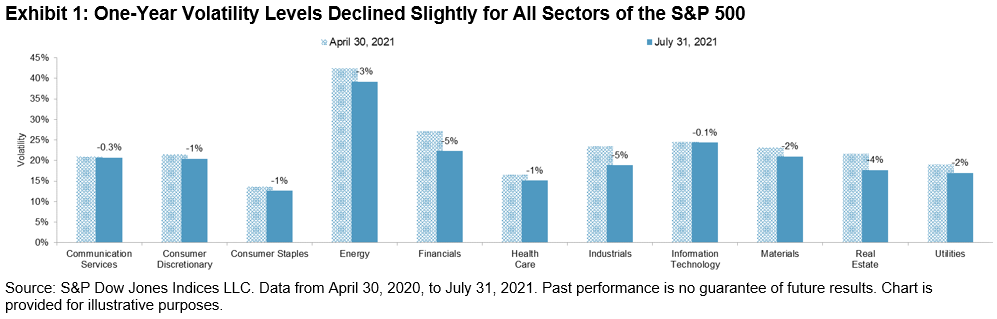

Volatility declined slightly in most sectors of the S&P 500. Even Energy was less volatile compared to three months prior.

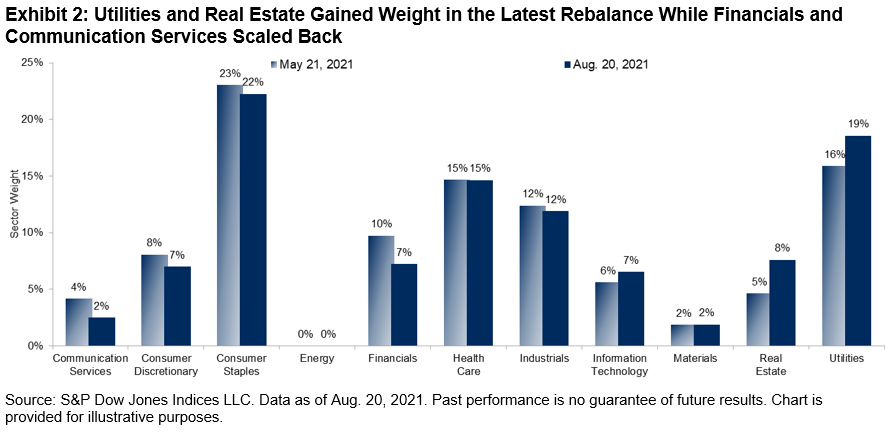

The changes in the latest rebalance for S&P 500 Low Volatility Index, effective after market close Aug. 20, 2021, are subdued compared to the flurry of activity in the previous rebalance.

Real Estate and Utilities continued to increase their weight in the index, with Financials and Communication Services showing the largest declines. The reduction in Financials is somewhat surprising given the sector’s relatively large drop in volatility. Despite this decline, however, Financials remains one of the most volatile sectors in the market, and the S&P 500 Low Volatility Index looks to minimize volatility at the stock level.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Digital Asset Infrastructure – Custody

Have your clients asked you about Bitcoin? Perhaps they’ve asked how to buy Bitcoin or another cryptocurrency. Maybe they’ve asked about signing up for a MetaMask wallet. Perhaps they have been confronted with choosing a centralized exchange (e.g., Coinbase) or a DEX (decentralized exchange—e.g., UniSwap). Diving into cryptocurrencies requires learning a new language involving terms like public and private keys, hot and cold storage, Ledgers and Trezors, and seed phrases. Beyond the jargon, the market is finding many ways to buy, trade, and hold crypto, and innovation is accelerating

As with any market advancing this quickly, the infrastructure is also progressing to confront issues such as evolving regulations, young technology, unfamiliar risks (potential for hacks, lost keys, etc.), and the need for operational and IT security. It is a diverse and complex market, and it can sometimes be difficult to navigate.

One particular logistical challenge is cryptocurrency custody. For institutions, choosing a fit-for-purpose custody solution is paramount to their success and competitiveness in this space.

Some financial institutions choose to avoid the cryptocurrency custody (and, more broadly, the infrastructure) challenge altogether. Concerned about the regulatory impact of holding Bitcoin or other cryptocurrencies outright, these institutions look toward products such as ETFs or futures that give exposure to cryptocurrencies without directly holding them.

For those who do want to hold cryptocurrencies directly, there are several alternative approaches.

While we see the occasional firm that wants to build its own custody (i.e., Standard Chartered building Zodia), an increasing number of top custodians, banks, and asset owners are starting to integrate with digital native custodians (e.g., firms that were created specifically to service the blockchain infrastructure). This may allow the traditional firms to manage operational complexities, navigate regulatory gray areas, and to get to market more quickly. As an example, BNY Mellon is planning to use Fireblocks for digital custody.1 Other known digital custodians include Anchorage, BitGo (which is being acquired by Galaxy), and Kingdom Trust.

Other digital market players are also adding custody. For example, some of the largest digital exchanges such as Coinbase and Gemini offer custody. Also, in the U.S., new guidance from the Office of the Comptroller of the Currency (OCC) opened the possibility of crypto custody at national banks. Avanti Bank and Anchorage Digital Bank are among the first to receive approval. In Europe, Sygnum, a Swiss digital bank, is now offering regulated custody for DeFi (decentralized finance) tokens to address this booming part of the market.

Seeing the market demand, firms offering institutional-grade custody for digital assets have grown quickly over the last few years, and new solutions continue to enter the market. These custodians help secure funds, protect against cyberattacks, apply robust cryptography, and create redundancies and checks to avoid human error and behavior. For custody, and other services, a firm that has SOC 1 Type 2 and Soc 2 Type 2 certification to validate institutional-grade operations is a key differentiator.

These new developments highlight an increasing institutional demand and focus regarding the growing cryptocurrency asset class. They also provide better quality services for large institutions such as banks, hedge funds, and asset managers.

Centralized liquidity and custody seem to contradict the decentralized thesis that underpins cryptocurrency and blockchain in general, but as the market shifts from early adopters to a broader reach with more mainstream and institutional players, the quality and convenience of centralized, sophisticated services appear to be gaining traction.

Stay tuned as this market develops!

Next up in Digital Asset Infrastructure: Institutional trading and exchanges – CEXes, DEXes, and more.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Exploring the Potential Implications of Market Reversals

How has the market’s response to the pandemic impacted the potential opportunity set? S&P DJI’s Anu Ganti and Hamish Preston examine where market reversals took place and what they could mean for active management and asset allocation strategies moving forward.

Read on: Style Bias and Active Performance

The posts on this blog are opinions, not advice. Please read our Disclaimers.The S&P Dividend Growers Indices: Examination of Risk, Return and Down-Market Performance

This blog, the final in a series of three, reviews the performance of the new S&P Dividend Growers Indices and highlights some of their defensive characteristics. They are designed to track companies with consistently increasing dividends while excluding the top 25% highest-yielding eligible companies. Only companies that increase dividends consecutively for at least 10 and 7 years for the S&P U.S. Dividend Growers Index and S&P Global Ex-U.S. Dividend Growers Index, respectively, are eligible to be included.

Risk/Return Statistics

Exhibit 1 shows these indices’ back-tested risk/return statistics over various periods. Over the full period, the S&P Global Ex-U.S. Dividend Growers Index outperformed its benchmark by 2.44% annualized, while the S&P U.S. Dividend Growers Index slightly underperformed by 0.16%. It is important to frame the U.S. index’s underperformance in the context of the index’s defensive qualities (examined in the next section) and from a risk-adjusted perspective.

Here, risk-adjusted return is the ratio of annualized return and annualized volatility. With respect to volatility, both indices were substantially lower than their benchmarks. The full period volatilities of the S&P U.S. Dividend Growers Index and S&P Global Ex-U.S. Dividend Growers Index were 2.15% and 2.60% lower, respectively. Thus, on a risk-adjusted basis, both indices displayed superior risk-adjusted returns.

Down-Market Performance

The first blog in this series showed that companies with consistently increasing dividends displayed greater financial strength. As expected, higher-quality companies tended to outperform during periods of market stress.

Exhibit 2 shows the S&P Dividend Growers Indices experienced lower drawdowns than their benchmarks across the full back-test period. More recently, the S&P U.S. Dividend Growers Index and S&P Global Ex-U.S. Dividend Growers Index outperformed by 4.21% and 1.36%, respectively, during Q4 2018 and by 5.11% and 3.84%, respectively, during the COVID-19-related drawdowns in March 2020.

The defensive nature of the S&P Dividend Growers Indices is further evidenced by their historical capture ratios. A downside capture ratio of less than 100 indicates that a strategy has lost less than its benchmark during months when the benchmark return was negative. Exhibit 3 shows the S&P U.S. Dividend Growers Index and S&P Global Ex-U.S. Dividend Growers Index had downside capture ratios of 78.97 and 78.84, respectively, across the full back-test period.

Conversely, the upside capture ratio measures how a strategy has performed relative to the benchmark during months when the benchmark return was positive. Both S&P Dividend Growers Indices had upside capture ratios of less than 100, indicating they tend to participate less fully during up months.

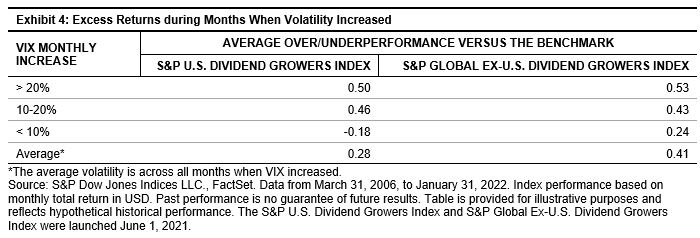

Another interesting way to examine the performance of the S&P Dividend Growers Indices is during periods of increasing volatility. Exhibit 4 shows the average monthly over/underperformance of each index across different thresholds of monthly increases in the CBOE Volatility Index® (VIX®).

Market volatility can cause significant price fluctuations in a portfolio; however, companies exhibiting sustained dividend growth tend to be higher quality and may help reduce volatility. When VIX increased more than 20% over the course of the month, the S&P U.S. Dividend Growers Index and S&P Global Ex-U.S. Dividend Growers Index outperformed by 50 bps and 53 bps per month on average, respectively.

Dividend Yield

Finally, let’s examine the historical dividend yield of the S&P Dividend Growers Indices. Compared with their benchmarks, the full-period average yield of the S&P U.S. Dividend Growers Index was 0.35% higher, while the S&P Global Ex-U.S. Dividend Growers Index was 0.55% lower.

Let’s recall that the objective of the index is to track companies that consistently raise dividends while excluding the top 25% highest yielding. The goal was not to generate superior yield but to select companies that are well managed and demonstrate sustainable growth. Thus, while the realized yield of the S&P Global Ex-U.S. Dividend Growers Index has generally been lower than its benchmark, this approach has produced superior total returns on absolute and risk-adjusted bases.

While dividend-paying stocks offer yield and the potential for price appreciation, not all dividend stocks are the same. Furthermore, certain dividend strategies may not be designed with the goal of earning a higher yield but rather greater price appreciation or lower risk. Overall, dividend growers tend to be higher-quality companies that exhibit superior risk-adjusted return and tend to outperform during down markets.

The posts on this blog are opinions, not advice. Please read our Disclaimers.