With appetite for higher conviction ESG strategies on the rise, how could these darker green approaches help market participants align investments with ESG values? Jon Winslade and Jaspreet Duhra of S&P DJI join Andrew Walsh of UBS Asset Management for a closer look at the S&P 500 ESG Elite Index.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

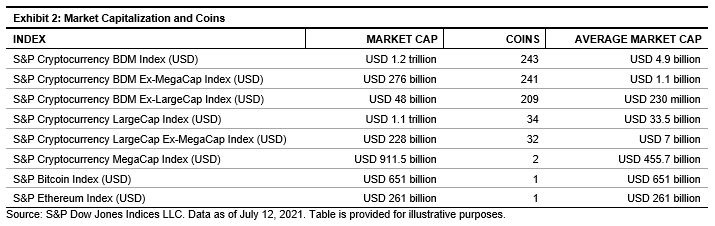

1 Source: S&P Dow Jones Indices LLC, USD 1.46 trillion, based on 950+ assets priced by Lukka Prime, as of June 30, 2021.

1 Source: S&P Dow Jones Indices LLC, USD 1.46 trillion, based on 950+ assets priced by Lukka Prime, as of June 30, 2021.