In April 2020, we launched the S&P PACTTM (Paris-Aligned & Climate Transition) Indices. The indices aim to align with a 1.5oC climate scenario, the EU’s minimum standards for EU Climate Transition Benchmarks and EU Paris-Aligned Benchmarks, and the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), while maintaining a broad, diversified exposure. The S&P PACT Indices consist of the S&P Paris-Aligned (PA) Climate Indices and S&P Climate Transition (CT) Indices. The index methodology excludes certain companies (exclusion effect), then reweights remaining constituents (reweighting effect) based on their climate performance (see Exhibit 1), as discussed in a previous blog.

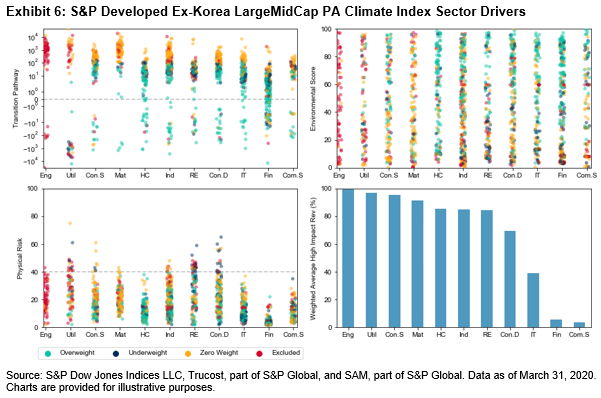

We published a paper explaining the weight attribution of constituents in the S&P PACT Indices, where we isolated the transition pathway, environmental score, physical risk, and level of high climate impact revenue as important weight drivers. Elaborating on Barbara’s recent blog, we highlight observations of how sector allocations were driven by climate factors and exclusions within the S&P 500® PACT and S&P Developed Ex-Korea PACT Indices.

Similar to the S&P Europe LargeMidCap PA Climate Index and the S&P Eurozone LargeMidCap PA Climate Index, the S&P Developed Ex-Korea LargeMidCap PA Climate Index and S&P 500 PA Climate Index saw large Energy exclusions due to oil, gas, and coal exposure. Within the S&P 500 PA Climate Index specifically, no Energy stocks were eligible due to these exclusions. Furthermore, the removal of highly intensive power generation companies affected Utilities.

However, unlike the S&P Europe LargeMidCap CT Index and the S&P Eurozone LargeMidCap CT Index, the Utilities sector of the S&P 500 CT Index experienced underweighting. While this was observed within the S&P 500 PA Climate Index due to additional power generation exclusions, the underweight in the S&P 500 CT Index was likely driven by climate factors, particularly high physical risk. Utilities companies were largely either well above or below their 1.5oC budget (assessed by Trucost’s Transition Pathway dataset). The only overweighted Utilities company in the S&P 500 PA Climate Index had the lowest physical risk among its peers, despite being slightly above its allocated carbon budget.

While companies are not individually required to be 1.5oC compatible for eligibility for the S&P PACT Indices, we observed those well over budget (around 102 in the S&P Developed Ex-Korea LargeMidCap PACT and S&P 500 PACT Indices) rarely saw any weight allocation, whereas those under budget frequently realize large overweighting.

Health Care experienced a large overweight in the S&P 500 and S&P Developed Ex-Korea LargeMidCap PACT Indices. In each region, we observed few Health Care companies well over their 1.5oC budget, and high physical risk was rarely an issue.

High climate impact revenues were constrained to avoid greenwashing. Most sectors had both high and low climate impact revenues streams. High climate impact revenues made the biggest impact on weights at the company level within sectors, rather than at sector level. Within sectors that had a mix of companies with high and low climate impact revenue streams, those with majority low climate impact revenues tended to be underweighted. This is particularly apparent within the Consumer Discretionary and Health Care sectors, as seen on the right-hand charts of Exhibits 2 and 3.

While there are further observations that can be made from the exhibits in this blog, we hope this picks out some key points of interest.

The posts on this blog are opinions, not advice. Please read our Disclaimers.