Decrement indices have gained popularity as the underlying assets of equity-linked structured products in Europe and Asia. According to SRP, among the 318 products across asset classes in France that matured or autocalled between April 2018 and March 2019, more than 32 were linked to decrement indices.1

One of the reasons behind this recent popularity is today’s low interest rate environment, which makes it challenging for structured product issuers to design attractive products. This triggered a search for a new underlying asset that could deliver cheaper optionality. Decrement indices were designed for this purpose. By eliminating dividend risk, issuers could provide more favorable terms at the structural level, such as higher participation rates and improved capital protection.

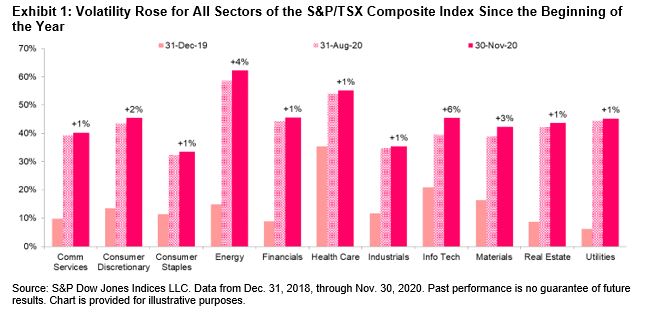

It is important to understand that the gain on favorable product terms does not come without cost. Exhibit 1 illustrates some of the tradeoffs for structured products linked to decrement indices compared with conventional indices. To understand the risk for the underlying index, it is worthwhile to look at the construction of decrement indices.

How Do Decrement Indices Work?

A decrement is an overlay applied to equity indices. A decrement index is constructed by deducting a predefined dividend (also known as a synthetic dividend) from a total return index on a daily basis. As total return can also be broken down into price return and realized dividends,2 a parity relation exists between price return and decrement index return with dividends added (see Exhibit 2).

Depending on whether the fixed synthetic dividend (refer to RHS in Exhibit 2) is greater or less than the actual realized dividends received (refer to LHS in Exhibit 2), the decrement index could underperform or outperform the corresponding price return index. To deliver returns similar to those of the price return index, the predefined dividend markdown should be roughly the same as the realized dividends. If the predefined dividend markdown is significantly larger than the average realized dividends, a decrement index could persistently underperform its price return version.

When the market is stable or steadily increasing, decrement indices tend to be more beneficial to investors compared with the price return index. In adverse market conditions, however, it is important to acknowledge that decrement indices may represent a large reduction in returns.

For example, during COVID-19 sell-off, the S&P 500® price return index dropped by 34% from Feb. 9, 2020, to March 23, 2020. For a 20-point decrement index starting from an initial index level of 1000, a 34% drop in the index level meant an increase in the return deduction from 2% to 2.6%.

Fixed Percentage Deduction versus Fixed Point Deduction

Decrement indices use two major methods to deduct the predefined dividends: fixed percentage or fixed points. On a daily basis, the former deducts a fixed percentage of the returns while the latter subtracts fixed index points from the index level.

The logic of using the fixed percentage method is that dividend yield tends to be stable over the long term. During the past 10 years, the trailing 12-month dividend yield for the S&P 500 was relatively stable, around 2%. Therefore, dividend markdowns for fixed percentage decrement indices are often in line with historical long-term dividend yield averages.

On the other hand, a fixed points deduction captures the consistency in dividend amounts in the short term, as companies are inclined to maintain more stable dividend policies compared to their earnings. For fixed points decrements, the effective percentage deduction on the index base date, which is calculated by fixed points divided by initial index level, is usually set to be consistent with the recent realized dividend yield.

These two methods are often close when the market is stable but could display significant differences in the movement of the underlying index level. Specifically, the percentage deduction from total return is constant for fixed percentage decrement indices; and variable for fixed point decrement indices, depending on the market movement direction (see Exhibit 3).

Key Takeaway

The decrement strategy is an index innovation that aims to solve specific challenges presented by structured products—–a low interest rate environment and the need to hedge dividend risk. Despite the simple construction, there are nuances that market participants may want to better understand, such as potential underperformance when deduction is too high and varying deduction methods. For more information on the S&P Decrement Indices, please refer to the “Fee Indices/Decrement Indices” section of the Index Mathematics Methodology document, as well as the S&P Dow Jones Decrement Indices Parameters.

1 SRP, Structured Products Performance Review, France, April 2018 to March 2019. Retrieved from https://afpdb.org/wp-content/uploads/2019/12/France-Performance-Report.pdf.

2 Including dividends reinvestment.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

The changes in latest rebalance of the

The changes in latest rebalance of the