Since S&P Dow Jones Indices announced that Tesla would be added to the S&P 500® on Dec. 21, 2020, many investors have contacted us asking when this transformative company will become a member of the S&P 500 ESG Index, the sustainable counterpart to the S&P 500. The answer, in brief, is that Tesla will not automatically join the S&P 500 ESG Index upon its addition to the S&P 500. Instead, Tesla will be assessed during the next annual rebalance of the S&P 500 ESG Index, taking place at the end of April 2021. But even then, inclusion into the index is not assured. Whether Tesla becomes an index constituent will be determined by its sustainability performance across many criteria relative to its peers.

Tesla’s ESG Score

The main driver of whether a company is selected to join the S&P 500 ESG Index is its S&P DJI ESG Score. This score is derived from the annual Corporate Sustainability Assessment (CSA), which is administered by SAM, a part of S&P Global. The CSA is a highly granular, industry-specific questionnaire based on financial material ESG metrics. Insights gathered from the CSA form the backbone of the ESG score that is used to select companies added to the S&P 500 ESG Index.

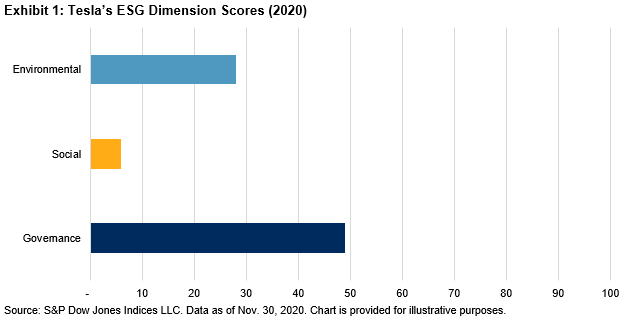

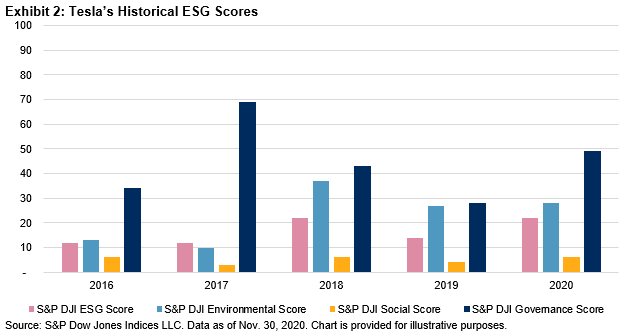

For this current assessment year, Tesla’s S&P DJI ESG Score was 22 out of 100, up 8 points from 2019’s score. This is driven by its ESG Dimension Scores, including an Environmental score of 28 (up 1 point from last year), a Social score of 6 (up 2 points), and a Governance score of 49 (up 21 points). Tesla does not fill out the CSA, so its S&P DJI ESG Score is determined based on research using publicly available information.

Many may be surprised to see such a low overall ESG score (and Environmental score) for Tesla, given its focus on electric vehicles. Specializing in “green” products, however, does not automatically ensure that companies will score well from an overall ESG perspective. The S&P DJI ESG Score is wide ranging in what it encompasses, as it is meant to capture a company’s broad sustainability performance.

In the Environmental dimension, Tesla of course scored well in the area of low carbon strategy, with a nearly perfect score of 99. However, the company scored low in environmental reporting, climate strategy, and environmental policy and management systems, which suppressed the company’s overall Environmental score.1 Tesla also scored especially low on social metrics across the board, which include human capital development, social reporting, and labor practice indicators. Tesla did comparatively well in the Governance realm, especially relative to the prior year.2

The S&P 500 ESG Index Methodology

So, what does this mean for Tesla’s standing in the S&P 500 ESG Index? We won’t know until the upcoming annual rebalance is finalized on the last business day of April 2021. At that time, Tesla will be measured against its peers across many ESG criteria. As mentioned earlier, however, the biggest determinant of the composition of the S&P 500 ESG Index is a company’s S&P DJI ESG Score. But it’s not just a company’s absolute performance that matters; a company also needs to rate well relative to its peers.

The S&P DJI ESG Score is used in two ways in the index methodology. First, the bottom 25% of companies in each GICS® industry group is screened out on a global basis. This prevents a company that is a good ESG performer locally but poor on a global basis from making it into the index. Second, companies are ranked by their ESG score within the S&P 500 and then selected from the top down to get as close as possible to 75% of the industry group’s original market capitalization.

Will Tesla make it through these two key screens and become a member of the S&P 500 ESG Index? Next April, we’ll know. The S&P 500 ESG Index has no early-entry rule that would afford Tesla extra privileges; it will be treated the same as any other company.

The author would like to thank Reid Steadman for his extensive contributions to this blog post.

1 According to the CSA, low carbon strategy (which is a unique criterion to the automobiles industry) is defined as an assessment of strategies implemented by companies to reduce the carbon intensity of their core portfolio, while climate strategy is defined as an assessment of strategies put in place by companies to address the scale of the challenge climate change represents for their industry, and environmental policy and management systems covers management tools implemented by companies in order to improve their environmental performance in a cost-effective way and reduce the risk of incurring fines or penalties for not complying with environmental legislation.

2 To provide some context for Tesla’s scores, the S&P DJI ESG Scores are normalized across global industries and are designed to be read as percentiles. Thus, a score of 22 means that that company had a higher score than 22% of its industry peers globally.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

The changes in latest rebalance of the

The changes in latest rebalance of the