In a recent webinar I moderated, Brie Williams of State Street Global Advisors joined me to discuss how environmental, social, and governance (ESG) data and investing are now at an important turning point. During that webinar, we answered some advisor questions. I encourage you to watch this replay if you missed it. We ran out of time to answer all the questions we received, so I thought it would be worthwhile to bring our discussion to Indexology to “extend our time” and, in that way, answer more questions advisors may have as they evaluate how and in what ways to position ESG investing. In this first post, I have grouped questions on the theme, “Why Now for ESG?” In a follow-up post, I will cover a second, related theme, “How Is the ESG Discussion Changing?”

Q: ESG has been around for a while. What is different now that should command our attention?

Brie Williams, State Street Global Advisors: When it comes to ESG investing, the world is changing. Investor engagement is growing while data and analytics that track the performance of these strategies are evolving. As a result, ESG adoption is accelerating.

- Globally, the percentage of retail and institutional investors that apply ESG principles to at least a quarter of their portfolios jumped from 48% in 2017 to 75% in 2019.1

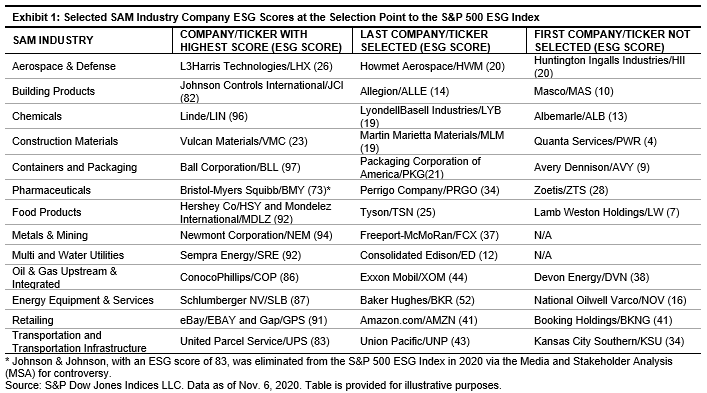

- Specific to scoring data, the more ESG data providers are investing in developing ESG scoring solutions, the more companies will prioritize reporting and disclosure. After all, we can only focus on financial materiality so distinctly because increased reporting in non-traditional areas has already been in motion.

Q: We always hear about incredible amounts of money tracking ESG, but is that all in other countries, or solely institutional clients? What do you see going on with ESG ETFs and mutual funds?

Brie: ESG is an evolving space and relatively small from an asset base and product offer space; however, development is becoming more dynamic and diverse, with new products and new issuers as well as conversions of existing products to ESG.

- Most of the assets lie in equity, where flows are favoring broad ESG over thematic.

- The industry is trending toward lower-cost solutions, with over 50% of U.S. ESG ETFs launched in the past two years having a net expense ratio under 20 bps.

- ETFs are helping to democratize access to ESG, enabling investors large and small to better realize their investment objectives.

And the cash flow story behind the ESG superhighway is dynamic.

- Sustainable funds attracted an estimated USD 45.7 billion in net flows globally during the first quarter of 2020, even while the overall fund universe suffered USD 384.7 billion in outflows as markets plunged in response to the pandemic.2

- We project a nearly eight-fold increase in global ESG ETF and indexed mutual fund assets, from USD 170 billion as of May 31, 2020, to more than USD 1.3 trillion by 2030.3

Q: Is ESG an idea with staying power, or is it a “flavor of the year” in the financial media and product marketing space?

Brie: Three trends are positioning ESG to transform from a check-the-box portfolio component to a significant component of a portfolio.

- The great reset in a turbulent 2020, with “S” and “G” issues at the forefront

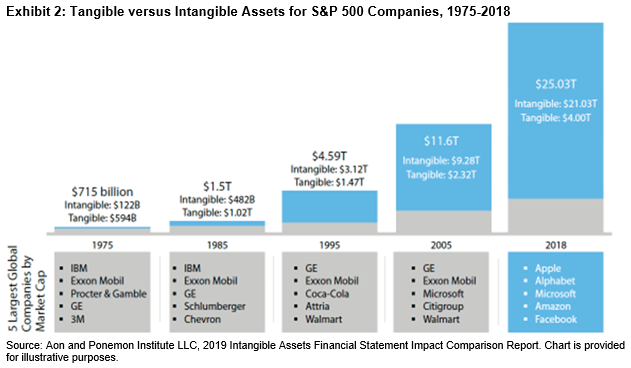

The management of “E” and “S” risks will likely emerge as the new standard of comprehensive corporate governance—and underscore how non-financial E, S, and G factors may affect long-term valuation.

- Investors are reshaping what’s next. Industry transformation is under way, helping investors to:

- Incorporate ESG factors for sustainable performance;

- Rely on better data to make better decisions;

- Gain ESG exposure with cost-effective ETFs; and

- Customize portfolios with ESG funds.

- Changing investment demographics

Large-scale wealth transfers—nearly USD 15.4 trillion in global wealth transferred by 20304—and a greater emphasis on living according to values have encouraged ESG adoption. Those changes will presumably reverberate and be magnified through increased government regulation and institutional investments.

1 BPN Paribas, “The ESG Global Survey 2019,” 2019.

2 Morningstar, March 31, 2020.

3 State Street Global Advisors, June 2020, based on Morningstar data as of May 31, 2020.

4 Wealth-X, “A Generational Shift: Family Wealth Transfer Report 2019,” June 2019.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

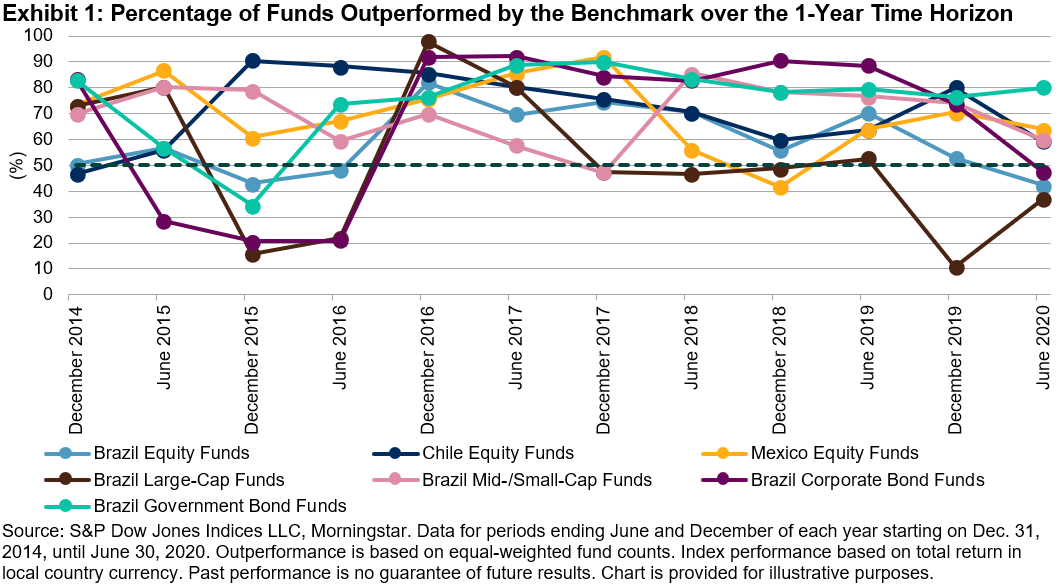

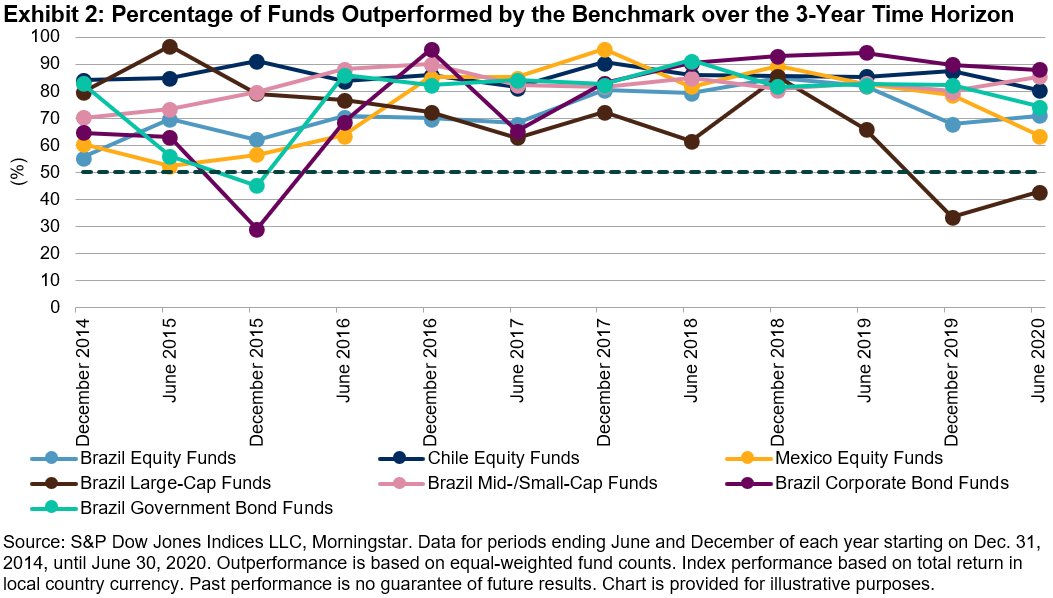

However, when compared with a longer time horizon, say a three-year period, we see that the percentage of active managers outperforming goes down.

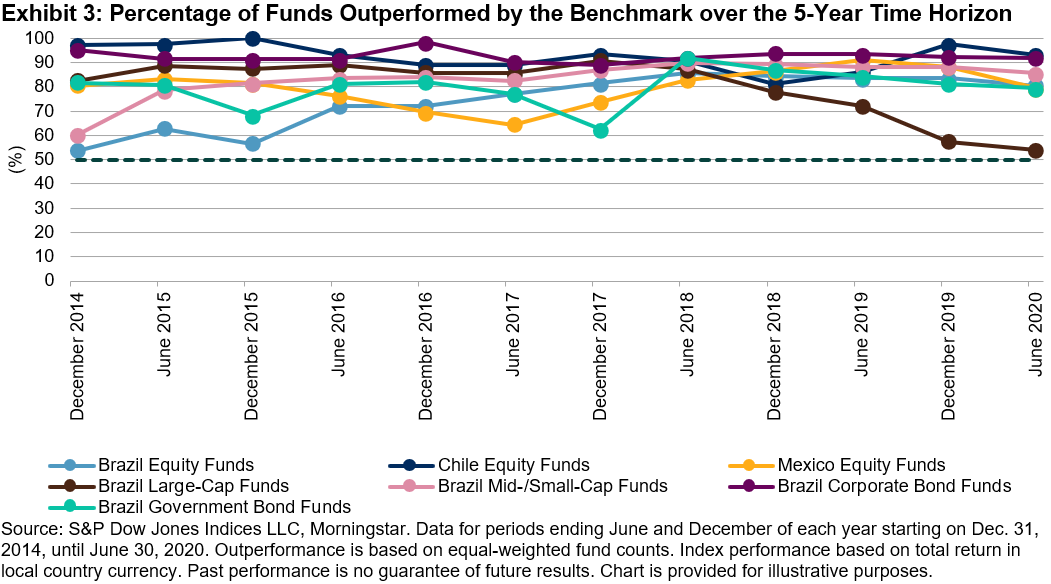

However, when compared with a longer time horizon, say a three-year period, we see that the percentage of active managers outperforming goes down. And when considering even longer time periods, like across a five-year period, the majority of active managers in all categories for all three countries were outperformed by their benchmarks.

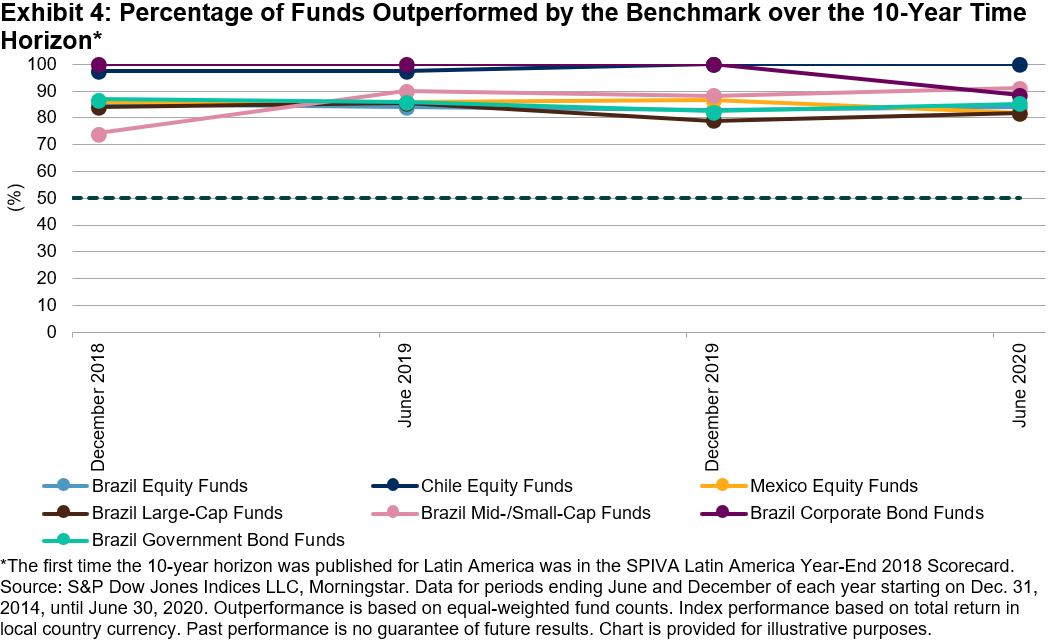

And when considering even longer time periods, like across a five-year period, the majority of active managers in all categories for all three countries were outperformed by their benchmarks. Lastly, for the 10-year period observed, the percentage of funds outperformed by their benchmarks converged in a range above 70%.

Lastly, for the 10-year period observed, the percentage of funds outperformed by their benchmarks converged in a range above 70%. As evidenced by the SPIVA scorecards, the majority of active managers underperform most of the time, especially across long-term horizons, demonstrating how difficult is to consistently beat the benchmark.

As evidenced by the SPIVA scorecards, the majority of active managers underperform most of the time, especially across long-term horizons, demonstrating how difficult is to consistently beat the benchmark.