The recently released SPIVA® Europe Mid-Year 2020 Scorecard had the unique opportunity to pit the performance of active funds against their passive benchmarks through an exceptionally rare event. The economic fallout from the coronavirus pandemic brought a period of extreme volatility, the likes of which have not been seen in Europe since the global financial crisis of 2008. In doing so, rather than highlight the opportunities available to active managers in such times, it exposed an alarming risk—a high dispersion in fund returns. In other words, there were far more occurrences of active funds significantly underperforming or outperforming their benchmark than usual.

H1 2020: A Tale of Two Quarters

The first half of 2020 can be characterized as a market crash followed by a modest recovery.

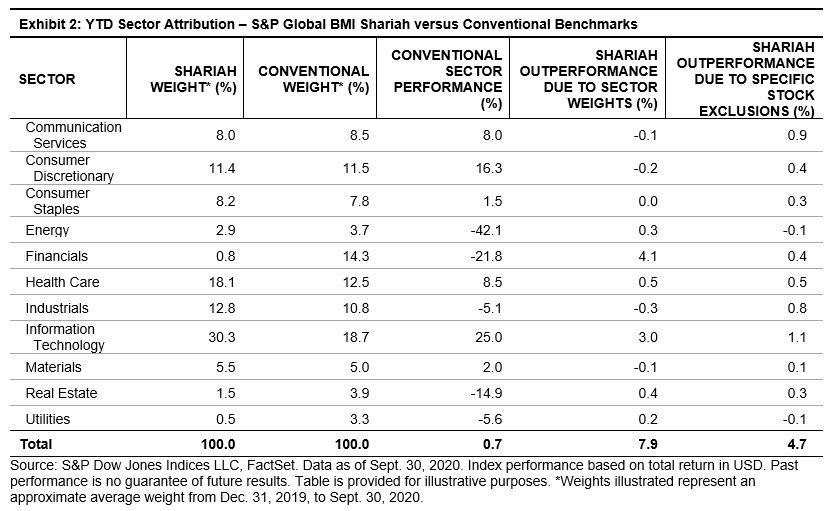

During the first three months of 2020, as the coronavirus pandemic began to wreak havoc across European equity markets, European equity funds suffered significant drawdowns. At this point, the skill of active fund managers came into question as, despite their ability to actively defend their positions, they were largely unable to avoid substantial losses.

The following three months featured a recovery in the market, following hope that the virus was coming under control and local economies were reopening. On average, European equity funds pared back their losses and recovered at a faster rate than the benchmark. However, as Exhibit 1 highlights, there was high dispersion in fund returns, indicating that the risks to active fund investors, in fact, remained high.

Mixed Fortunes for European Equity Funds

Exhibit 2 illustrates the dispersion in returns through the five different periods featured in the SPIVA Europe Mid-Year 2020 Scorecard. In each case, we can see that European equity funds largely exhibited normally distributed returns. However, there was significant variation in the tails, particularly when comparing the more recent (YTD and 1-year) returns with the annualized medium- and long-term (5- and 10-year) returns. In the short term, positive supernormal returns were rare but still possible despite volatile market conditions. However, investors hoping to grow their investment should be wary that they were just as likely to select a fund on the opposite end of the spectrum that exhibited negative supernormal returns. Furthermore, the diminishing spread between the 75th and 25th percentiles and the shortening of the tails in each distribution over the 3-, 5-, and 10-year periods highlight that such returns have not typically persisted into the future.

In conclusion, the short-term risk that any individual investor in an active fund could experience returns substantially below the benchmark should be compensated with evidence that active funds typically outperformed over the long term. In the SPIVA Europe Mid-Year 2020 Scorecard, 87% of European equity funds underperformed the S&P Europe 350® over the 10-year period ending June 30, 2020. Therefore, without such evidence, the risk of supernormal fund returns is arguably unrewarded and, until the recent events, may have been largely unexposed.

In conclusion, the short-term risk that any individual investor in an active fund could experience returns substantially below the benchmark should be compensated with evidence that active funds typically outperformed over the long term. In the SPIVA Europe Mid-Year 2020 Scorecard, 87% of European equity funds underperformed the S&P Europe 350® over the 10-year period ending June 30, 2020. Therefore, without such evidence, the risk of supernormal fund returns is arguably unrewarded and, until the recent events, may have been largely unexposed.